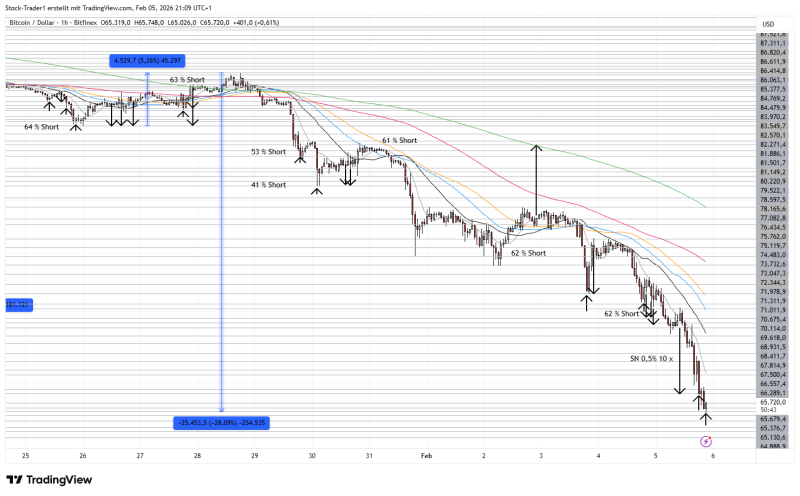

⬤ Bitcoin took a serious hit during the latest session, dropping roughly 11% in what turned out to be one of the more dramatic intraday moves we've seen recently. The cryptocurrency market kept trading through the entire downturn without pause, which meant traders could jump in and react the second prices started sliding.

⬤ Looking at the charts, BTC spent most of the session trending downward with heavy selling pressure and barely any attempts at recovery. The decline was sharp enough that many traders figured the day's low had probably already been reached, though positioning around that level continued as the session wore on.

⬤ What made this drop particularly intense was the fact that crypto never sleeps. Traders could open short positions and stack additional stop-sell orders at any moment as the price kept falling. Unlike traditional markets that close and leave you waiting, crypto's continuous trading meant every order got filled in real time throughout the entire decline.

⬤ This whole episode really shows how 24/7 trading in Bitcoin can turn up the volume on price swings. When the market never closes, there's always liquidity available, which means positioning changes and risk management moves happen instantly during volatile sessions rather than building up overnight.

Peter Smith

Peter Smith

Peter Smith

Peter Smith