Bitcoin absorbs massive 60,000 BTC exchange inflows while whales stay calm, creating a classic BTC accumulation setup before potential new highs.

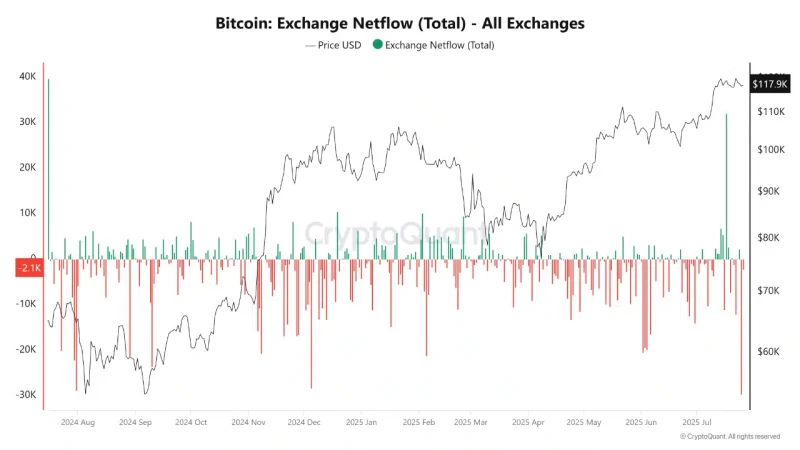

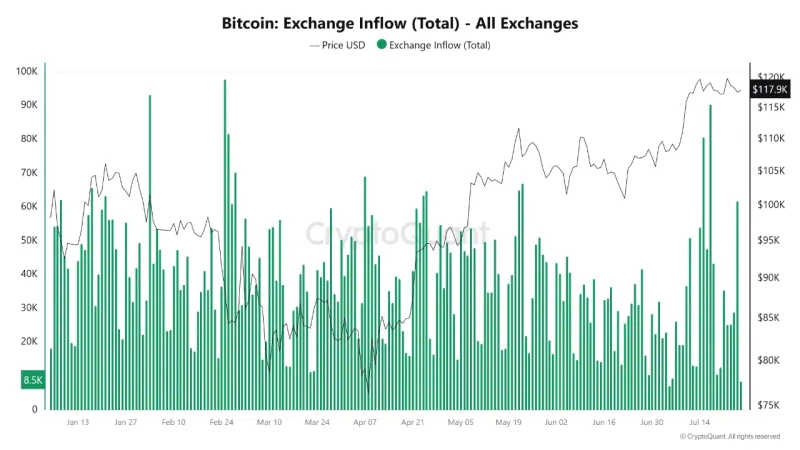

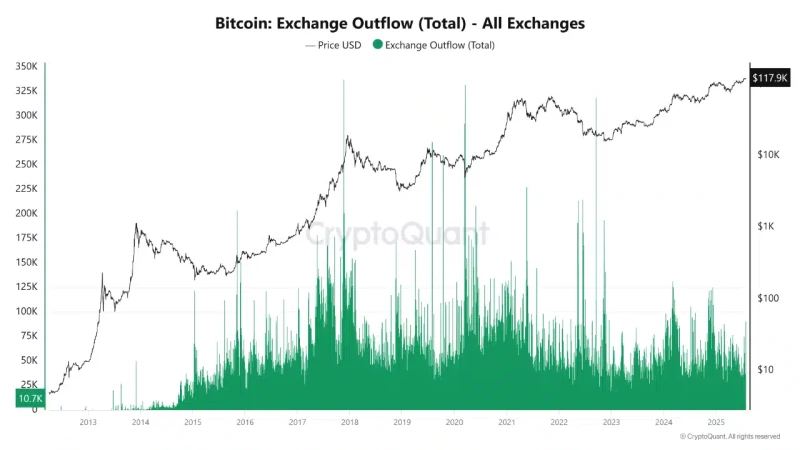

Something crazy just happened with Bitcoin, and it's actually pretty bullish. Over 60,000 BTC hit exchanges in one day – normally that screams "dump incoming" – but the market just shrugged it off. Even better, more Bitcoin left exchanges than came in, with net outflows hitting a yearly high of 29,000 BTC.

While retail traders are going nuts in the $116K-$120K range, the whales are doing absolutely nothing. And that's exactly why this might be setting up for another leg higher.

The whole thing looks like textbook accumulation. You know how it works – Bitcoin goes sideways for a bit, shakes out the weak hands, then suddenly everyone's asking "how did I miss that move?" The smart money sees it coming because they're the ones staying calm while everyone else panics.

Bitcoin (BTC) Market Absorbs Huge Supply Like It's Nothing

Let's break down what actually happened here. Over 60,000 BTC flowed into exchanges – that's usually when people start freaking out about a massive sell-off. But instead of crashing, Bitcoin did the opposite. Outflows were even bigger at 90,000 BTC, creating that net outflow of 29,000 BTC.

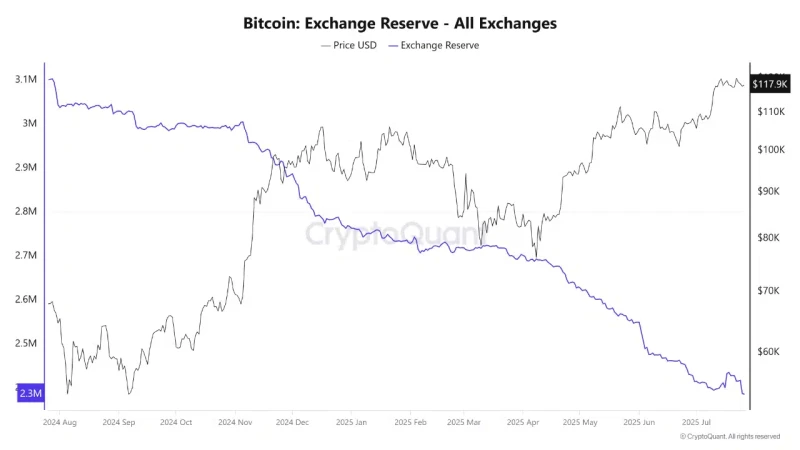

Exchange reserves are now sitting at fresh lows, which means long-term holders are still pulling their coins off platforms. That's not what happens during real weakness. When Bitcoin's actually in trouble, you see panic selling and exchanges filling up with coins people are desperate to dump.

This market just absorbed a huge injection of supply without even blinking. That's strength, not weakness, even if the price action looks messy.

Bitcoin (BTC) Retail vs Whales: The Real Story

Here's where it gets interesting. Retail is absolutely going crazy right now – tons of smaller orders flying around in Futures markets, especially in that tight $116K-$120K zone. Classic FOMO and fear trading mixed together.

But you know what's missing? Big whale sell orders. The players who actually move markets are just sitting there, totally unbothered by all the chaos. That's not the behavior you see at market tops.

When whales start panic selling, that's when you worry. When they're this calm during what looks like turbulence? History says that usually means they're preparing for the next move up.

The fact that Bitcoin can handle this much selling pressure without breaking key levels shows the demand is still rock solid. Retail might be nervous, but smart money knows what's up.

This whole setup screams accumulation phase – that quiet period before Bitcoin decides to remind everyone why it's the king of crypto. The whales staying silent while retail gets emotional? That's basically the playbook for what happens before major moves higher.

Bottom line: when the big players aren't panicking, neither should you. This looks less like a top and more like Bitcoin getting ready for its next surprise.

Peter Smith

Peter Smith

Peter Smith

Peter Smith