- What Does “No KYC” Really Mean?

- 1. CoinExchangeCanada – Homegrown Favorite

- 2. Hodl Hodl – Global P2P Marketplace

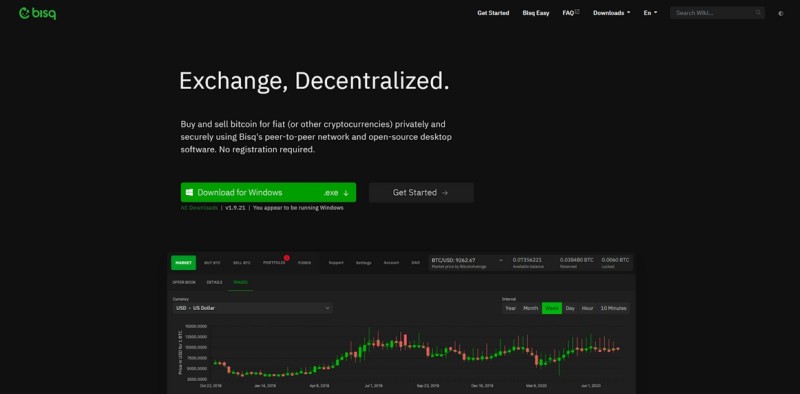

- 3. Bisq – Anonymity at Its Core

- 4. Maya Protocol DEX – Cross-Chain Without KYC

- 5. AtomicDEX(Komodo) – Multi-Asset Privacy Trading

- 6. PancakeSwap – Binance Smart Chain DEX

- 7. KuCoin – No Mandatory KYC for Basic Use

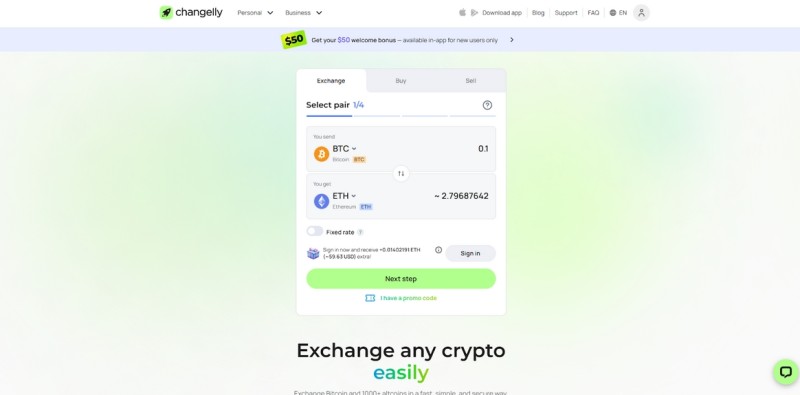

- 8. Changelly PRO – No KYC Up to Limits

- 9. BitMax (AscendEX) – Limited No KYC Access

- 10. Uniswap – Ethereum DEX with No KYC

- 11. Thorchain – Cross-Chain DEX Without KYC

- FAQ – No KYC Crypto Exchanges

- Final Thoughts

This has fueled demand for the no kyc exchange model — platforms where traders can buy, sell, and swap crypto without submitting passports, driver’s licenses, or other personal documents.

Whether you’re a privacy advocate, an international traveler, or simply someone tired of long verification delays, no KYC crypto exchanges offer an appealing alternative. In this guide, we’ll dive deep into what makes them different, the benefits and risks, and the most reputable platforms available as of August 2025.

What Does “No KYC” Really Mean?

KYC stands for Know Your Customer, a regulatory process requiring users to verify their identities before accessing a platform’s services. This often involves uploading sensitive documents such as government-issued ID, proof of address, and — in some cases — a live selfie video.

While these measures are designed to combat fraud and money laundering, they also introduce certain downsides:

- Reduced privacy — your data is stored by a third party.

- Longer onboarding times — verification can take hours or days.

- Barriers for certain users — especially those in underbanked or sanctioned regions.

A no KYC exchange flips this model by allowing at least some trading, deposits, or withdrawals without identity checks. While limits are often placed on unverified accounts, the trade-off is clear:

Faster registration – often instant account creation.Stronger privacy – no personal documents handed over.Wider access – available to users in more jurisdictions.Lower friction – ideal for quick, smaller trades.

Still, privacy comes with responsibility — you must choose platforms wisely and understand the risks.

1. CoinExchangeCanada – Homegrown Favorite

CoinExchangeCanada has established itself as one of the most reliable no kyc exchange platforms for Canadian and North American users. It allows trading of major cryptocurrencies like Bitcoin, Ethereum, and popular stablecoins without requiring full identity verification, as long as users stay within set limits. Transparent fees and lightning-fast order execution appeal to both beginners and seasoned professionals. Its intuitive interface and responsive customer support enhance the overall trading experience, and regular updates ensure top-notch security and system stability.

2. Hodl Hodl – Global P2P Marketplace

Hodl Hodl operates as a peer-to-peer Bitcoin marketplace, enabling users to trade directly without handing over custody of funds to the platform. By using multisignature escrow, it protects both buyers and sellers from fraud, while allowing transactions to occur without the need for KYC verification. This decentralized approach preserves user privacy and offers borderless access to crypto, ideal for those in restricted or sanctioned regions. Its built-in reputation system and dispute resolution mechanism help maintain fairness and trust among traders worldwide.

3. Bisq – Anonymity at Its Core

Bisq is a fully open-source desktop application designed for privacy-conscious users seeking to buy and sell Bitcoin without any registration or centralized control. Operating over the Tor network, Bisq leverages a decentralized peer network and multisig escrow to prevent censorship and enhance anonymity. Its lack of a central server makes it extremely resilient to shutdowns or interference from authorities. While the interface may be less intuitive for newcomers, advanced users benefit from unparalleled privacy and control over their funds.

4. Maya Protocol DEX – Cross-Chain Without KYC

Maya Protocol is a decentralized exchange inspired by THORChain that facilitates native asset swaps across multiple blockchains without wrapped tokens or intermediaries. Users connect their wallets and execute trades instantly while retaining full custody of their funds throughout the process. This protocol prioritizes interoperability and seamless cross-chain liquidity, making it especially attractive to DeFi enthusiasts moving assets between chains. The fully permissionless nature means no identity checks are required, preserving user privacy at every step.

5. AtomicDEX(Komodo) – Multi-Asset Privacy Trading

AtomicDEX, developed by Komodo, integrates a decentralized exchange with a multi-coin wallet, enabling users to trade dozens of cryptocurrencies peer-to-peer without ever surrendering their private keys. Its atomic swap technology allows trustless trading without middlemen, increasing security and privacy. Supporting major coins like Bitcoin, Ethereum, Litecoin, and a broad range of altcoins, AtomicDEX caters to traders who want flexibility and control. The platform continually evolves to enhance user experience, with frequent updates and community-driven development.

6. PancakeSwap – Binance Smart Chain DEX

PancakeSwap is the largest decentralized exchange on Binance Smart Chain, offering permissionless token swaps with no KYC requirements whatsoever. Its vast liquidity pools and diverse token listings make it one of the fastest and cheapest ways to trade BSC-based assets. Users connect wallets like MetaMask or Trust Wallet and execute trades instantly, retaining full control over their funds. The platform also supports yield farming, staking, and other DeFi features, appealing to a wide range of decentralized finance participants.

7. KuCoin – No Mandatory KYC for Basic Use

KuCoin is a popular centralized exchange that allows users to trade and withdraw cryptocurrencies up to certain limits without completing KYC verification. This makes it a semi no KYC option, appealing to privacy-conscious traders who want access to a broad selection of tokens and user-friendly tools. While higher withdrawal limits and fiat operations require verification, the platform maintains a good reputation for security and customer service. KuCoin also offers futures trading, margin trading, and a native token with rewards programs.

8. Changelly PRO – No KYC Up to Limits

Changelly PRO provides an intuitive trading platform with competitive fees and instant crypto swaps, requiring no KYC for accounts under certain withdrawal thresholds. It supports a wide range of cryptocurrencies and integrates with various wallets, enabling users to trade seamlessly without lengthy onboarding. This makes it convenient for traders who prioritize speed and privacy over full regulatory compliance. The platform also features advanced charting tools and API access for professional traders.

9. BitMax (AscendEX) – Limited No KYC Access

BitMax (now AscendEX) offers a comprehensive crypto trading experience with spot, futures, and margin markets, allowing small-scale trades and withdrawals without mandatory KYC. This provides privacy benefits for casual users or those who prefer limited exposure. It has a robust security infrastructure and a broad asset listing, making it attractive for diverse trading strategies. However, for larger withdrawals or full platform access, identity verification is required.

10. Uniswap – Ethereum DEX with No KYC

Uniswap is the leading decentralized exchange on the Ethereum blockchain, enabling anyone to swap ERC-20 tokens directly from their wallet without registration or KYC. Its automated market maker (AMM) model provides liquidity from user pools, supporting thousands of tokens and projects. While Ethereum gas fees can be high, Uniswap remains a key platform for permissionless trading and liquidity provision. Its open-source nature means anyone can create new trading pairs or deploy forks.

11. Thorchain – Cross-Chain DEX Without KYC

Thorchain is a decentralized liquidity network enabling trustless swaps of native assets across multiple blockchains without relying on wrapped tokens or custodians. By using continuous liquidity pools and incentivized node operators, Thorchain offers decentralized cross-chain trading without any KYC requirements. It appeals to users seeking privacy, decentralization, and seamless asset movement across ecosystems like Bitcoin, Ethereum, Binance Chain, and more. While it’s powerful, users should understand the risks inherent in DeFi and smart contracts.

FAQ – No KYC Crypto Exchanges

1. What does “No KYC” actually mean?

“No KYC” means that a crypto exchange or platform allows users to trade without submitting personal identity documents like passports, driver’s licenses, or proof of address. However, some no KYC exchanges may still impose limits on trading volume or withdrawals until verification is completed.

2. Are no KYC exchanges legal?

Yes, in many jurisdictions no KYC exchanges operate legally, especially decentralized ones. But regulations vary widely by country, so it’s essential to check your local laws before using such platforms.

3. Do no KYC exchanges have trading or withdrawal limits?

Most no KYC platforms impose limits on how much you can trade or withdraw without verifying your identity. These limits help exchanges comply with regulations while still offering privacy-friendly options.

4. Can I withdraw fiat currency from no KYC exchanges?

Some no KYC exchanges allow limited fiat withdrawals without ID, but many focus on crypto-to-crypto trading only. To withdraw larger amounts in fiat, identity verification is usually required.

5. Are decentralized exchanges (DEXs) always no KYC?

Most permissionless DEXs do not require any identity checks because they do not custody user funds or manage accounts. However, some hybrid or centralized platforms branded as “DEXs” may have KYC policies.

6. Which no KYC exchange is best for beginners?

For beginners, user-friendly platforms like CoinExchangeCanada and Hodl Hodl are recommended. They offer easier interfaces and helpful support, whereas more privacy-focused options like Bisq or AtomicDEX can be complex for newcomers.

7. What are the main risks of using no KYC exchanges?

Risks include regulatory shutdowns, lower liquidity, potential security vulnerabilities, and counterparty risks especially in P2P trading. Users must take precautions such as enabling 2FA, not storing large balances online, and researching platform reputations.

8. How can I maximize my privacy while using no KYC exchanges?

Use privacy-focused wallets, avoid linking your exchange account to personal emails or phone numbers, and consider using VPNs or Tor where appropriate. Always manage your own private keys securely.

Final Thoughts

In 2025, no kyc exchange platforms are more accessible and diverse than ever. Whether your priority is privacy, cross-chain trading, or altcoin variety, there’s a suitable option out there. The key is balancing convenience with security — and remembering that with privacy comes the responsibility of safeguarding your own funds.

Editorial staff

Editorial staff

Editorial staff

Editorial staff