The cryptocurrency market has witnessed significant whale activity in Cardano (ADA) recently, with large-scale token sales raising questions about the altcoin's near-term trajectory. Despite substantial selling pressure from major holders, ADA's price action suggests underlying market strength that could signal broader investor confidence.

Large Holders Create Market Turbulence

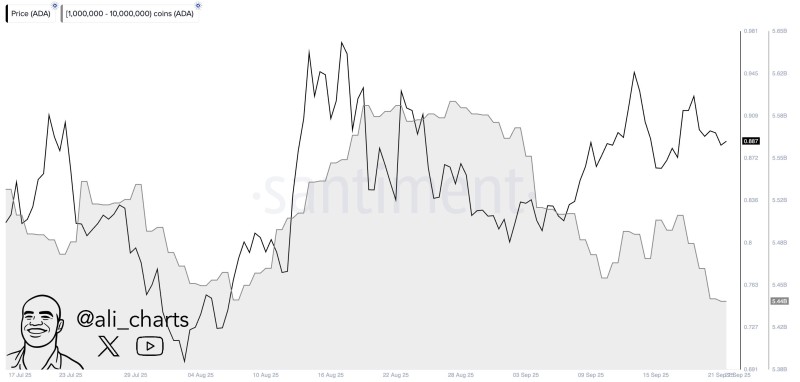

Recent data from Ali shows that Cardano whales dumped 160 million ADA tokens within just 96 hours, representing roughly $140 million worth of selling at current market rates. The selling came primarily from wallets containing 1 million to 10 million ADA, a segment that typically influences short-term price movements significantly.

The technical picture reveals an interesting divergence between whale behavior and price performance. While large holder positions dropped from approximately 5.62 billion ADA to 5.44 billion ADA, the token's price has remained relatively stable, trading in a tight range between $0.87 and $0.90. This resilience suggests that retail and institutional demand is effectively absorbing the whale selling pressure.

Several factors could explain why these large holders are reducing their positions. Profit-taking appears likely given ADA's recent price gains, while capital rotation into major cryptocurrencies like Bitcoin and Ethereum ahead of key macroeconomic events may also be driving the moves. Additionally, growing speculation around potential cryptocurrency ETFs could be pulling liquidity away from alternative coins, and some whales might simply be testing market liquidity by selling large positions to gauge buying interest.

The critical support level investors should monitor is $0.85. A decisive break below this threshold could potentially trigger additional selling and push prices lower in the short term.

Market Outlook

Moving forward, several key factors will determine ADA's direction. Continued whale outflows would obviously create additional headwinds, making ADA's ability to hold the $0.85-$0.87 support zone crucial for maintaining bullish momentum. Broader cryptocurrency market sentiment, largely driven by Bitcoin's performance, will also play a significant role in shaping ADA's trajectory.

Despite the recent selling pressure from large holders, Cardano's ability to maintain levels above $0.88 demonstrates solid underlying demand from other market participants. While short-term price volatility seems inevitable given the ongoing whale activity, ADA's resilient performance suggests that investor confidence in the project's long-term potential remains intact.

Peter Smith

Peter Smith

Peter Smith

Peter Smith