Shiba Inu (SHIB) faces a challenging week with significant drops in burn rate, Shibarium transaction count, and whale activity.

SHIB Metrics Signal Bearish Start

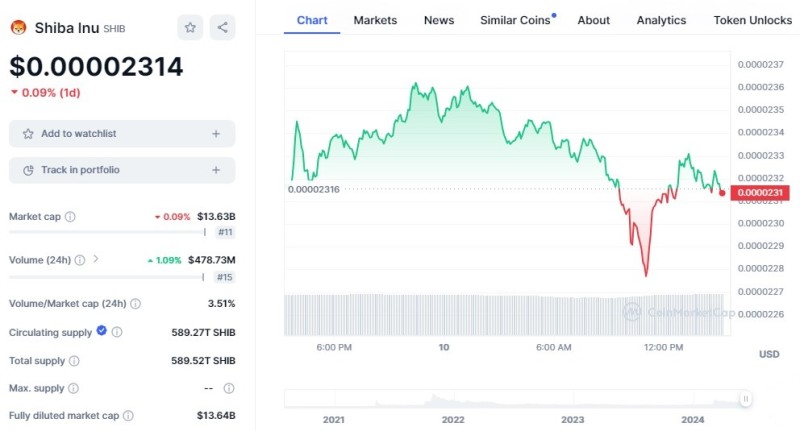

Shiba Inu (SHIB) might be heading for its most unpredictable week this month, as many of its vital metrics are starting off on a bearish note. Alongside a minor price decline of 0.21% over the past 24 hours, SHIB’s burn rate, Shibarium transaction count, and whale accumulation trends have also experienced significant downturns.

At the time of writing, SHIB’s burn rate has plummeted by 74.50%, with only 271,470 SHIB incinerated, equivalent to a mere $6. This figure is notably low for a project boasting a market capitalization exceeding $13.6 billion. The community typically expects more robust performance in terms of burn rate, making this drop particularly concerning.

Shibarium Transaction Count Drops

Shiba Inu’s Shibarium transaction count also shows a steep decline. With just 2,990 transactions recorded in the past 24 hours, engagement on the Shibarium network is at its lowest point ever. This metric's downturn indicates reduced activity and interest, potentially affecting the overall utility and adoption of the Shibarium platform.

Data from IntoTheBlock reveals a 41% decrease in whale activity overnight. This reduction suggests that major SHIB holders are either hesitant or strategically waiting for better market conditions before making significant moves. Whale behavior is a crucial indicator of market sentiment and can significantly impact SHIB’s price trends.

Potential for a Bullish Reversal

Despite these concerning metrics, there is a potential silver lining. Historically, significant downturns in SHIB’s metrics have often preceded a major drawdown followed by a recovery. If the current bearish trends exhaust sellers, new buyers might seize the opportunity to enter the market at a discount, potentially driving up SHIB’s price, burn rate, and transaction count.

Shiba Inu has demonstrated resilience in the face of past market challenges. While the current metrics are troubling, they might also set the stage for a market correction. An influx of new buyers could lead to an epic rebound in SHIB’s burn rate and renewed interest from whale traders, helping the asset recover some of its recent losses.

Conclusion

As the week unfolds, monitoring these key metrics will be essential for understanding SHIB’s trajectory. The burn rate, Shibarium transaction count, and whale activity will provide critical insights into the market dynamics surrounding Shiba Inu. While the current outlook appears bearish, the potential for a bullish reversal remains, making it a crucial week for SHIB investors and enthusiasts.

Usman Salis

Usman Salis

Usman Salis

Usman Salis