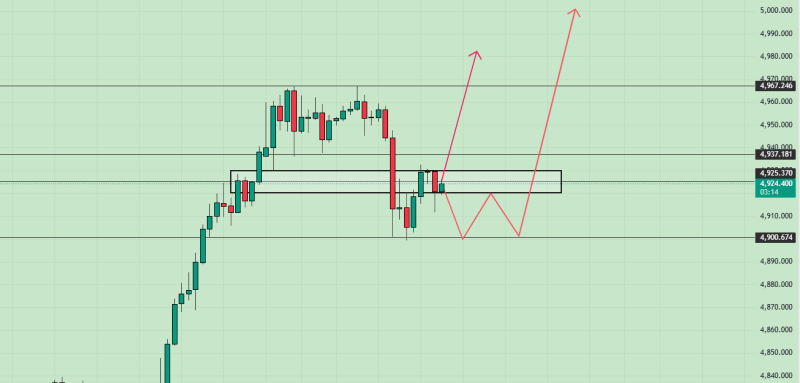

⬤ Here's the thing—XAU's been hanging around above the 4,925 mark after pulling back from recent highs, and that's got everyone's attention. The double top pattern everyone's talking about? It's not confirmed yet, not while price keeps defending this neckline area. What we're seeing is consolidation within a tight range, which tells us the market's undecided rather than committed to any clear direction.

⬤ That 4,925 zone isn't just some random number—it's clearly working as solid short-term support right now. Buyers keep stepping in around this level, which means we could be looking at accumulation happening up here rather than a completed reversal. The chart's showing repeated bounces off this area, and that's significant.

⬤ But let's be real—there's definitely bearish pressure lurking around, especially after price got rejected near that 4,960–4,970 resistance zone. If we get a decisive close below 4,925, that's when the double top gets confirmed and sellers officially take control. Until that happens though, the neckline support's still intact and the bears haven't won yet.

⬤ For gold traders, this is a make-or-break moment. If 4,925 holds, we're likely staying in consolidation mode with possible rebound scenarios in play. But if it breaks? We could be looking at increased downside risk and a shift in short-term sentiment. Either way, all eyes are on this support level right now.

Peter Smith

Peter Smith

Peter Smith

Peter Smith