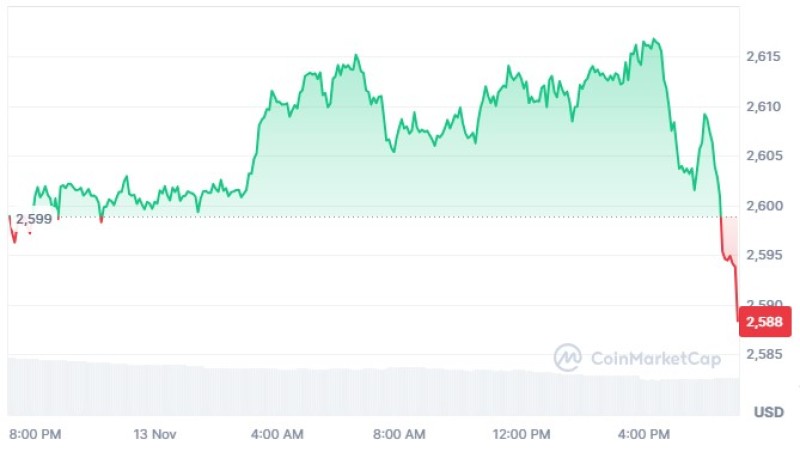

XAU/USD faces a downturn as gold prices dip to $2,588, driven by a strong dollar and rising market optimism following Trump’s election.

Factors Behind XAU/USD Price Decline

On November 4, with XAU/USD trading around $2,750, bearish signals on the chart hinted at potential downward pressure. Following these signals, the price declined to $2,588, briefly dipping below this level, marking the lowest point for XAU/USD since mid-September. This decline has several factors behind it, impacting investor sentiment around the precious metal.

One key driver affecting the XAU/USD price is the strength of the U.S. dollar. A robust dollar tends to reduce gold's appeal as a safe-haven asset, as it makes commodities priced in dollars more expensive for foreign buyers. Additionally, recent optimism in the markets, fueled by President Trump's fiscal and monetary policy pledges, has shifted investor focus toward riskier assets, diverting attention from XAU/USD.

Traders are closely watching today’s U.S. Consumer Price Index (CPI) data, set to be released at 16:30 GMT+3. The CPI release could influence market sentiment for XAU/USD, as any unexpected inflation trends could sway investor interest back toward safe havens like gold.

Technical Analysis of XAU/USD: Key Levels to Watch

Currently, the XAU/USD price sits at the lower boundary of a blue trading channel, adjusted to recent trading data. The channel's median line, previously acting as support, now serves as resistance. Two possible scenarios may unfold following the release of the inflation data:

- Bullish Rebound: Buyers could push for an uptrend from the lower boundary of the blue channel, with resistance anticipated around $2,655.

- Bearish Continuation: Sellers may maintain control, potentially pushing XAU/USD below the $2,588 mark, weakening the relevance of the blue channel as a price support range.

Conclusion

As market participants await the inflation report, the XAU/USD price remains sensitive to both U.S. dollar strength and evolving market sentiment. Whether the current downtrend holds or reverses could depend on inflation data and ongoing market optimism.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah