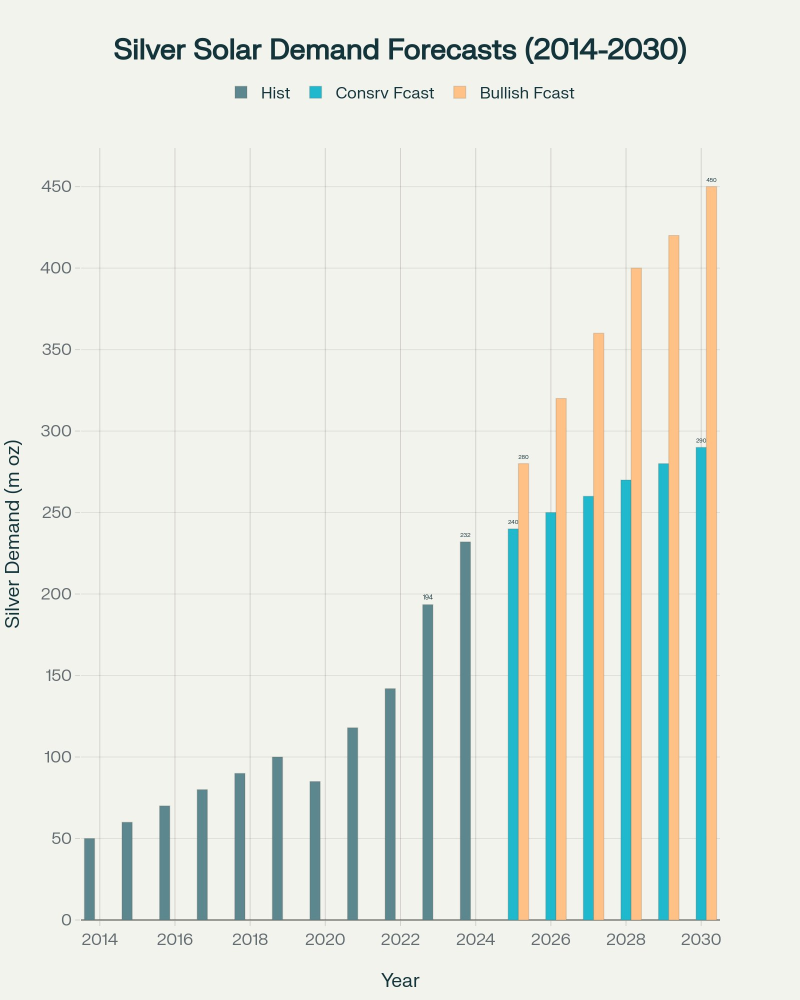

⬤ Silver consumption in the solar industry has exploded over the past decade, jumping from under 60 million ounces in 2014 to over 230 million ounces in 2024. New projections show this trend isn't slowing down—conservative estimates put solar demand at around 290 million ounces by 2030, while more aggressive forecasts reach nearly 450 million ounces. The numbers reflect how quickly solar panel manufacturing is ramping up worldwide, with silver playing a critical role in photovoltaic technology that can't easily be replaced.

⬤ The problem is that silver mining hasn't kept pace. While demand from renewable energy keeps climbing, production levels have stayed relatively flat. This growing mismatch is becoming impossible to ignore—what started as gradual growth in the early 2010s has turned into a steep upward curve. The gap between how much silver the world needs and how much it's producing is widening fast, and that's starting to reshape conversations around metal markets and clean energy infrastructure.

The widening gap between supply and demand raises serious questions about long-term market balance and what it means for silver prices as renewable energy adoption accelerates.

⬤ What makes this particularly interesting is that solar power isn't some niche industry anymore—it's a major driver of global silver consumption. As countries push harder on climate goals and solar installations multiply, both conservative and bullish scenarios point in the same direction: sustained upward pressure on silver demand. With supply growth lagging behind, the evolving dynamics could have real implications for pricing and investment strategies in metals tied to the energy transition.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah