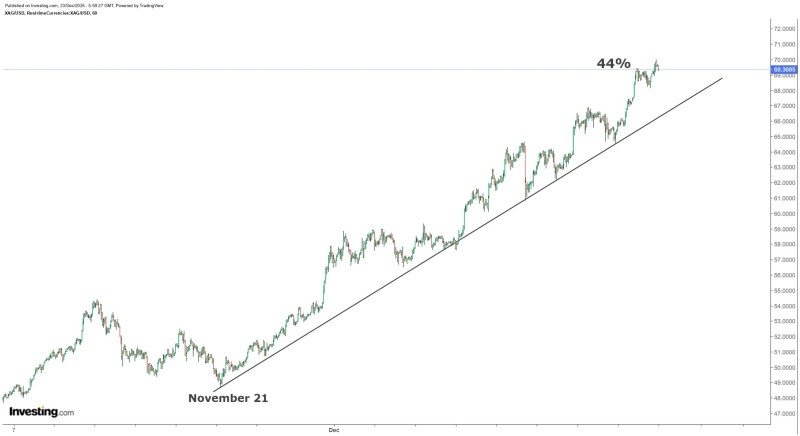

⬤ Silver has delivered an impressive performance since late November, climbing roughly 44% over the past month and pushing toward the $69 mark. The rally has followed a clean upward trendline, unfolding with striking consistency rather than wild price swings. What stands out isn't just the size of the move—it's how orderly it's been, with steady gains building on each other throughout the advance.

⬤ The price action tells a clear story: higher highs, higher lows, and a rising trendline that hasn't broken once during this run. Pullbacks have been notably shallow, typically staying in the 3–4% range before buyers jump back in. This pattern points to strong underlying demand and shows that sellers haven't been able to gain any real traction. The lack of deeper retracements has kept the momentum pointed firmly upward, giving bears little opportunity to challenge the trend.

⬤ This kind of sustained strength creates interesting market dynamics. Traders waiting for a bigger dip to enter have largely been left on the sidelines, watching silver climb without offering clear entry points. Meanwhile, the relentless advance can breed frustration among those who missed the initial move, sometimes pushing late-comers to chase prices higher as the rally continues. It's a psychological dynamic that often develops during extended trends.

⬤ Silver's recent run matters beyond just the metal itself—it's a textbook example of how powerful momentum combined with disciplined trend structure can persist even when pullback expectations run high. Extended rallies with limited corrections tend to make markets more sensitive to any shift in sentiment, especially if profit-taking eventually kicks in after such a strong advance. While the uptrend remains intact, the steep pace of gains means watching price behavior closely becomes even more important as silver trades near the top of its recent range.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah