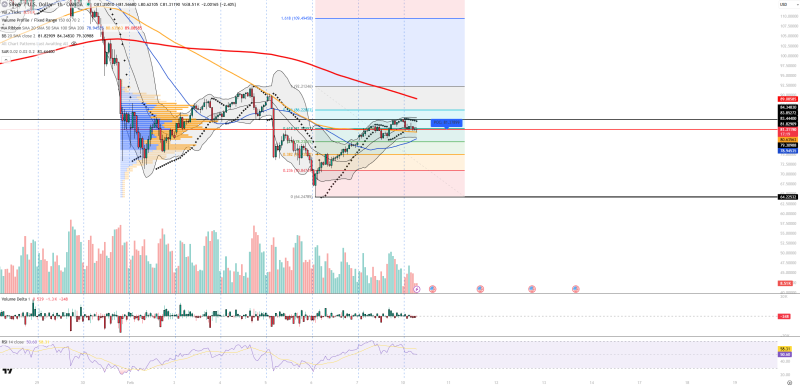

⬤ Silver continues to trade in a narrow consolidation range after recovering from recent lows, holding near the balance level around $81.38. Price action shows hesitation below the medium to long-term downtrend zone, with recent candles remaining small and indecisive within a broader silver long-term structure.

⬤ The chart shows repeated rejection near resistance around $83.12 and $84.34, while support sits layered below at $81.38, $80.64, and $79.00. Momentum indicators reinforce this neutral structure—RSI fluctuates between 50 and 58, showing neither strong bullish nor bearish pressure. Volume remains weak and doesn't confirm any breakout attempt. Volume Delta also stays slightly negative, meaning buyers aren't stepping up despite holding above support inside a silver consolidation range.

⬤ Technical tools paint the same picture. Price trades near the middle Bollinger Band with compression continuing—classic sign of volatility contraction. The Volume Profile shows the Point of Control around $81.38 acting as equilibrium. Parabolic SAR sits below price, protecting the short-term recovery, yet momentum remains fragile and unable to push into the XAG resistance zone. Every upside attempt fades as price approaches the upper boundary.

⬤ What happens next largely depends on external drivers—US macro data and Dollar Index movements. Stronger risk appetite may pressure silver lower, while dollar weakness could support short-term rebounds. Until volatility expands and volume increases, silver remains stuck in a balance phase where any real move requires a clear catalyst rather than purely technical pressure. For now, traders are watching and waiting.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah