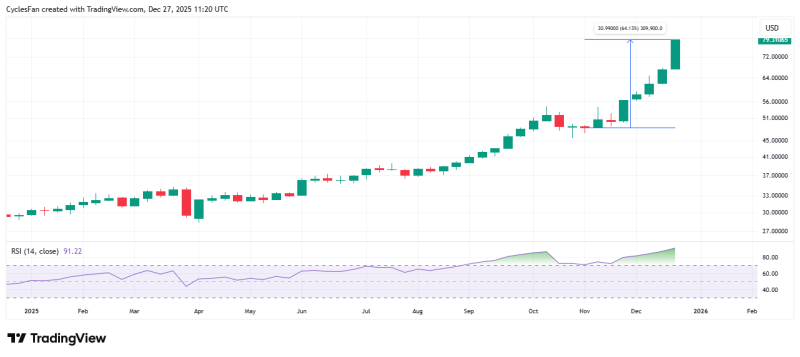

⬤ Silver has accelerated sharply higher heading into year-end, climbing 64% over the past seven weeks after bottoming near $48.32 in November. The 14-week Relative Strength Index now sits at 91.22, reflecting the intensity and speed of the current rally. The metal has broken above earlier consolidation patterns and is pushing toward the upper range of its recent price channel as December trading continues.

⬤ The rapid shift into high-momentum territory stands out on longer timeframes. RSI readings above 90 are uncommon on weekly charts, signaling powerful buying pressure as Silver extends its run. If the metal were to add another 70% over the next three to five weeks, it would reach approximately $135 while the RSI would approach levels last seen in January 1980.

⬤ The surge builds on months of steady gains earlier in the year before the breakout accelerated through the fourth quarter. Silver has decisively cleared its summer trading range, with weekly candles showing a consistent upward sequence and momentum indicators maintaining strength throughout the advance.

⬤ Extreme momentum phases in precious metals often coincide with major turning points or the continuation of longer-term trends. With Silver already up sharply in a compressed timeframe and the RSI nearing historical extremes, traders are watching to see whether the rally extends further or begins to cool after this unusually strong multi-week performance.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova