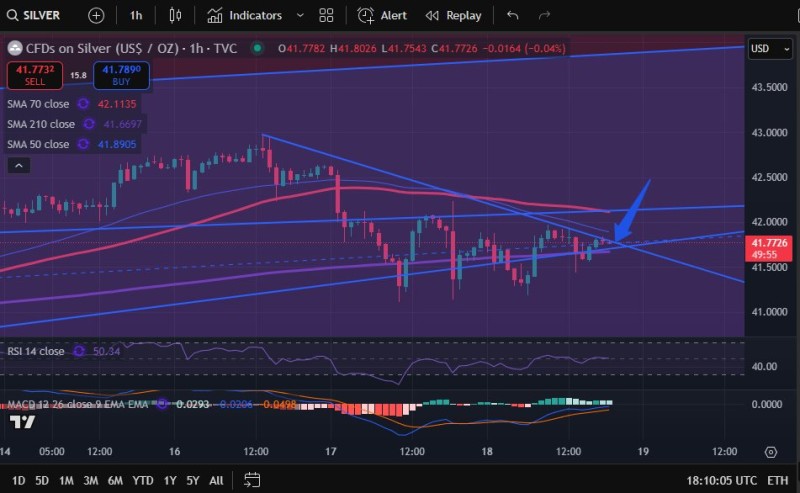

Silver has been stuck in a frustrating pattern for traders, repeatedly hitting the same resistance wall around $42. With the precious metal trading near $41.77, we're seeing a classic battle between buyers trying to push higher and sellers defending key levels. The question now is whether silver has enough momentum to finally break through or if we'll see another rejection.

Current Price Action and Key Levels

Silver is facing its biggest test at the $42 resistance zone. This isn't just any random level - it's been rejected multiple times, making it a psychological barrier as much as a technical one. Each time silver approaches $42-$42.20, sellers step in aggressively.

On the downside, $41.50 is providing some cushion for now, but if that breaks, traders are watching the $41 level as the next meaningful support. What's interesting is how tightly packed the moving averages are right here. The 50, 70, and 210-period simple moving averages are all clustered between $41.66 and $41.89, which shows just how compressed this consolidation has become.

The RSI is sitting right in the middle at 50.3, basically screaming "indecision." Meanwhile, the MACD is starting to show some early bullish signs, but it's still too weak to get excited about. The real story will be told when silver either breaks above $42.20 or fails again at $42.

Why This Level Matters So Much

This resistance isn't happening in a vacuum. The dollar has been relatively strong, which naturally puts pressure on precious metals. Then there's the whole Federal Reserve situation - every time there's talk about interest rates, silver gets whipsawed because of its dual nature as both an industrial metal and a safe haven.

Silver traders know that industrial demand can drive prices, but when economic uncertainty kicks in, people also buy it as protection. Right now, both sides of that equation are creating uncertainty at this key level.

What Happens Next

If silver finally breaks and holds above $42.20, we could see a quick move to $43.50, and if momentum really picks up, $45 isn't out of the question. But here's the thing - silver has faked out traders before at this level. A real breakout needs volume and follow-through, not just a quick spike that gets sold into.

On the flip side, if $41.50 gives way, we're probably looking at a test of $41, and that could get messy if buyers don't show up.

Usman Salis

Usman Salis

Usman Salis

Usman Salis