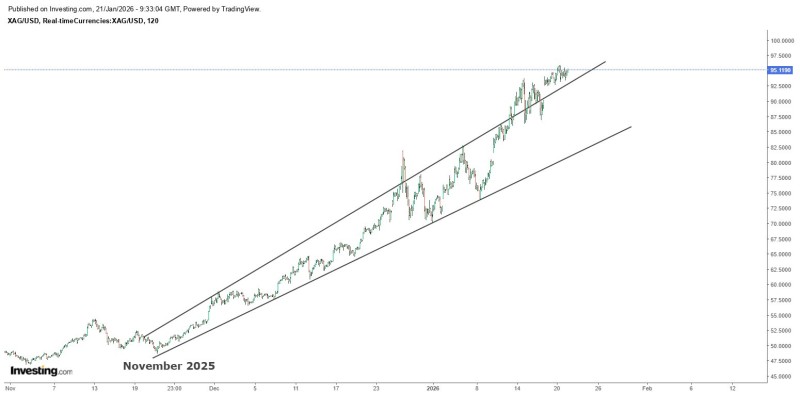

⬤ Silver's locked in around the $95 zone, trading above the upper band of a rising broadening channel that's been building for about two months. Price action's slowed down but hasn't cracked—buyers are still in control, absorbing earlier gains without giving much ground.

⬤ The metal's been riding above the channel's upper boundary, showing persistent buying pressure even as volatility picks up. This trend kicked off in November 2025 when silver shifted into a clear uptrend—higher highs, higher lows, the whole package. Since then, it's been moving inside an expanding channel with wider swings but steady upward momentum.

⬤ What's interesting here is the pause. Silver rallied hard, hit the channel top, and now it's consolidating—not dropping. Pullbacks have been shallow and brief, with no real push back toward lower channel support. Buyers keep stepping in at higher levels while sellers can't force any real breakdown. That tells you the uptrend's still alive.

⬤ This consolidation matters for the broader precious metals space. Silver reflects both industrial demand and macro sentiment, so when it holds above key trend lines like this, it signals confidence in the structure. Whether it breaks higher or settles into a range depends on what happens next, but right now XAG/USD's choosing stability over correction.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir