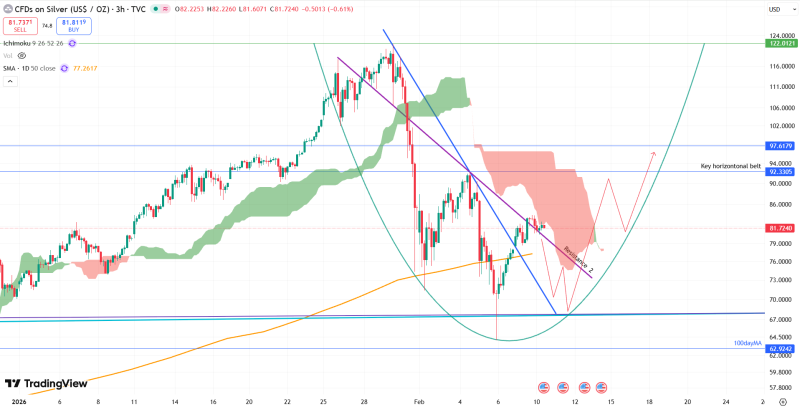

Silver is at a crossroads. The metal pushed above a notable resistance mark on the 3-hour chart, but the move has stalled — and the Ichimoku cloud overhead tells you why. Breaking one level doesn't mean breaking the zone, and right now XAG sits squarely in the middle of that tension.

Resistance Is a Zone, Not a Line

Price action on the 3-hour chart shows silver clearing a marked resistance level, yet the broader Ichimoku cloud continues to act as a ceiling. The cloud isn't a single barrier — it's a dense structural area, and until price closes convincingly above it, the breakout remains incomplete. A horizontal belt within the zone adds another layer of friction, keeping bulls in check for now.

The breakout did spark short-term bullish momentum, but the weight of the cloud structure suggests consolidation isn't over. As seen in previous metals setups, momentum often pauses before expansion — silver has a history of grinding sideways within resistance before picking a direction. Based on current positioning, a revisit to lower support levels remains on the table before any durable upside continuation. More context on these dynamics is available in the silver bullish momentum outlook.

Support Shelf Turns Structural — Watch for Accumulation

The level that previously capped price is now doing the opposite — holding it up. That kind of resistance-to-support flip is widely read as accumulation rather than rejection, suggesting that buyers are stepping in at a level the market already respects. Similar setups were analyzed in silver breakout confirmation patterns, where metals consolidated at flipped resistance before trending higher.

The overall picture is neutral-to-bullish as long as silver trades between the support shelf and the Ichimoku cloud overhead. The longer support holds, the more conviction builds behind an eventual breakout. Failure to clear the resistance zone would simply extend the consolidation — but price compression in commodities markets often resolves with a decisive directional push, a dynamic well-documented in silver technical trend setups.

Peter Smith

Peter Smith

Peter Smith

Peter Smith