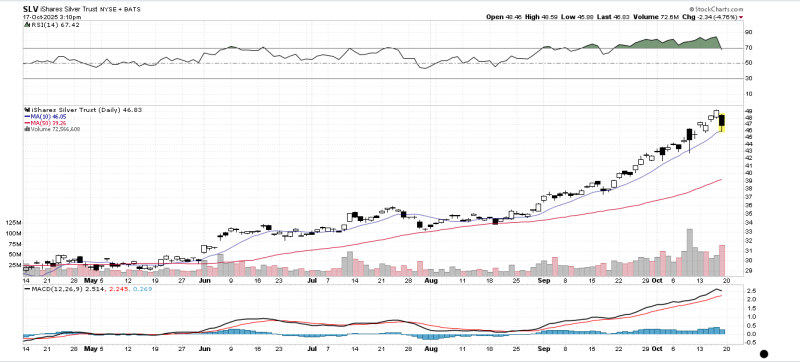

● Trader T.Kamada recently pointed out how well the iShares Silver Trust (SLV) is performing. The ETF is holding above its 10-day moving average while riding a strong uptrend. It last touched the 50-day moving average back in August and has been climbing steadily ever since, showing solid technical strength.

● Even though things look good, some analysts are worried about potential tax reforms targeting commodity ETFs. These changes could hurt smaller funds through reduced trading or even force some into bankruptcy. There's also concern about money and talent leaving the market.

● Critics say taxing investment vehicles like SLV directly might actually hurt government revenues if it scares away traders. Some industry experts suggest raising corporate tax rates instead, which would bring in steady money without messing up the ETF market.

● These proposed changes could ripple beyond silver to affect the whole financial sector—jobs, income taxes, corporate taxes, the works. With silver rallying on industrial demand and as an inflation hedge, any policy shifts could have real consequences for investors and regulators.

● Silver's technical strength and demand fundamentals keep drawing investors in—though policy debates on the horizon could shape where things go from here.

Usman Salis

Usman Salis

Usman Salis

Usman Salis