Brent crude surpassed $91 per barrel, marking an 18% increase this year. As geopolitical tensions and supply constraints persist, traders speculate on the longevity of the rally.

Brent Crude's Ascent Above $90

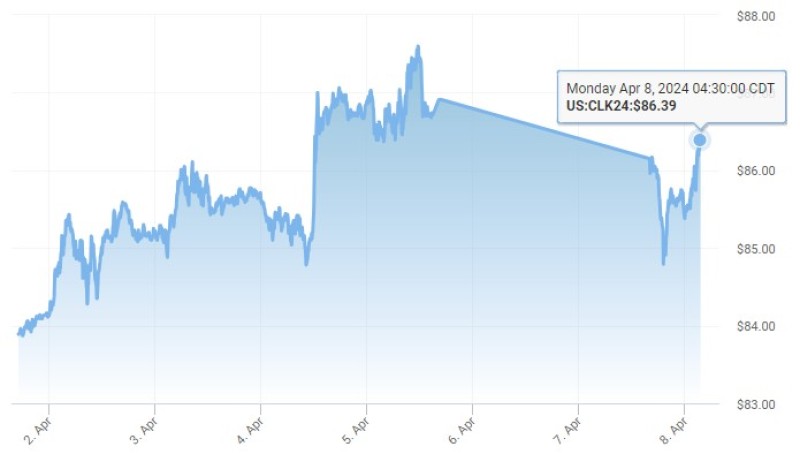

Traders are closely monitoring the recent surge in oil prices, which soared above $90 per barrel, a threshold unseen since October. Brent crude, the global benchmark, escalated to $91 per barrel on Friday, reflecting an 18% surge in prices for the year.

Similarly, the US benchmark West Texas Intermediate exhibited robust growth, climbing by 21%.

The recent upward trajectory in oil prices, following a period of consolidation, is attributed in part to escalating tensions in the Middle East. Concerns about a potential widening conflict, including repercussions from an alleged Israeli attack on Iran's consulate in Damascus, have contributed to market unease. Analysts assert that even if geopolitical tensions alleviate, sustained economic growth in major regions like the US, Europe, and China coupled with supply constraints by OPEC+ will likely maintain elevated prices.

Market Insights and Forecast

Paul Horsnell, Standard Chartered's global head of commodities, emphasizes the intricate interplay between supply, demand dynamics, and geopolitical factors in influencing oil prices. He anticipates prices to remain above $90 per barrel in the foreseeable future. The International Energy Agency's latest report forecasts a slowdown in supply growth from sources outside the OPEC+ alliance, projecting a decrease from 2.4 million barrels per day in 2023 to 1.6 million barrels per day in the current year.

With OPEC+ maintaining control over supply dynamics, prices are expected to stay elevated barring a significant economic downturn in major economies. Ehsan Khoman, MUFG's head of commodities, highlights the potential for OPEC+ nations to relax production constraints should oil prices surge beyond $100 per barrel to safeguard their export interests. However, the delicate balance between supply, demand, and geopolitical tensions will continue to dictate the trajectory of oil prices in the coming months.

The ECB's Stance on Interest Rate Cuts

Meanwhile, amidst concerns over Eurozone inflation nearing the European Central Bank's target and stagnant economic growth, policymakers are anticipated to maintain interest rates at their upcoming meeting. The persistence of services inflation, coupled with robust wage growth, underscores the ECB's cautious approach. While discussions about rate cuts loom, consensus suggests that a decision may be deferred until June when policymakers will assess more comprehensive data on wage growth and inflation trends.

Analysts remain divided on the ECB's potential actions regarding interest rates. While some, like Mariano Cena from Barclays, anticipate a shift in the policy statement to hint at potential rate cuts in June, others, like Paul Hollingsworth from BNP Paribas, suggest that ECB President Christine Lagarde may provide nuanced guidance during the post-meeting press conference without committing to a specific course of action. The ECB's forthcoming decisions will significantly impact market sentiment and economic outlook in the Eurozone.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah