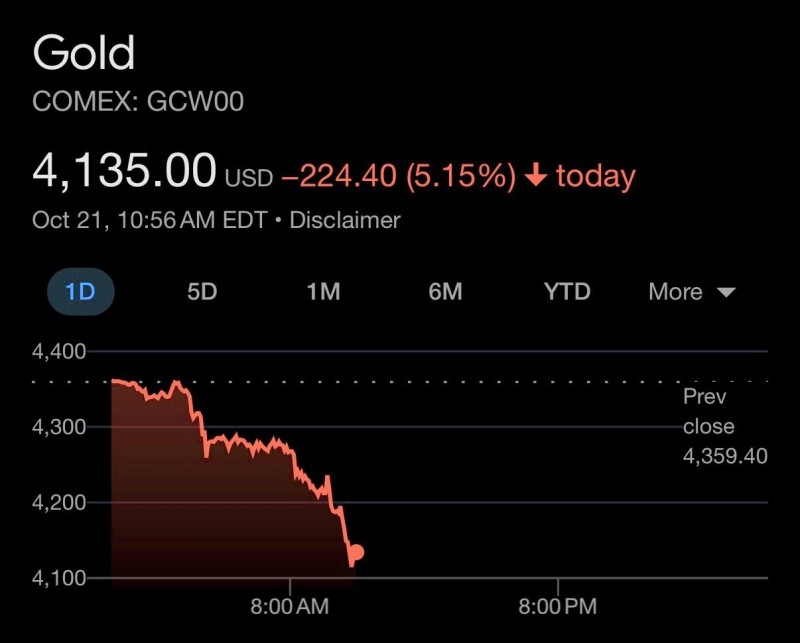

Gold just had its worst day in over a decade. The precious metal plummeted $224 in a single session, dropping from $4,359 to $4,135 — a 5.15% decline that caught many traders off guard. This sharp move marks gold's steepest fall since the infamous 2013 crash, when prices collapsed after the Federal Reserve signaled it would start pulling back on stimulus.

What Happened

The sell-off was relentless. Starting in the morning session, prices accelerated downward as stop-loss orders triggered wave after wave of selling. By the close, gold had erased nearly a month of gains in just hours. According to Stock Sharks, the collapse came as investors rushed toward cash and higher-yielding assets, abandoning the traditional safe haven amid a stronger dollar and rising Treasury yields.

Several forces combined to fuel the drop: the U.S. dollar surged to multi-week highs as traders bet on rates staying elevated longer than expected, while 10-year Treasury yields climbed, making bonds more attractive than non-yielding gold. After months of steady gains, speculators also started taking profits, which only intensified the downward pressure. Add to that some cooling inflation data, and suddenly gold's appeal as a hedge looked less convincing.

Historical Context

Big single-day drops like this are rare for gold. The last comparable crash happened in 2013 when the metal lost over 9% in two days after Fed taper talk spooked the market. That event marked a major turning point, leading to years of sideways trading. Today's macro backdrop is different — inflation is still above target and global debt remains near record levels — but the panic selling feels eerily similar.

Despite the dramatic fall, some analysts believe the long-term uptrend remains intact as long as prices hold above the $4,000–$4,050 support zone. Central banks continue buying gold, and geopolitical risks haven't disappeared.

Opinion is split on where gold goes from here. Bulls see this as an overreaction and a buying opportunity within a larger uptrend. Bears argue that rising yields and a strong dollar could push prices even lower, possibly testing below $4,000. The answer will likely depend on upcoming U.S. inflation reports, Federal Reserve commentary, and how global tensions evolve in the coming weeks.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah