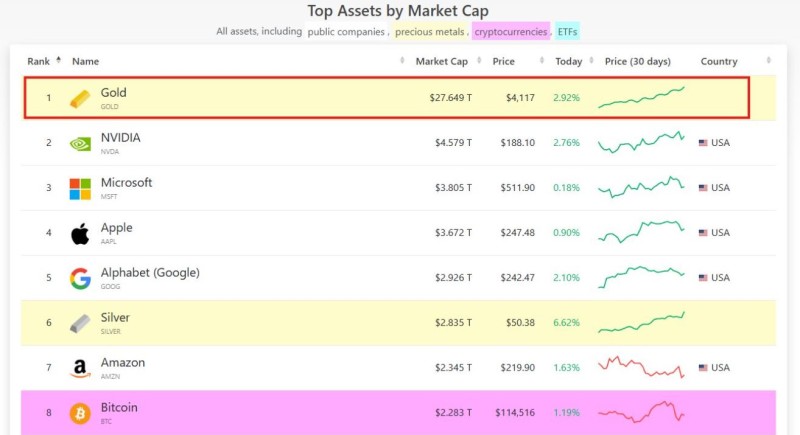

Gold (XAU) has reclaimed its throne as the world's most valuable asset, reaching a market capitalization of $27.6 trillion. This milestone puts it well ahead of major tech companies and cryptocurrencies, signaling a significant shift in investor sentiment toward traditional safe-haven assets during uncertain times.

Gold's Dominance Over Tech Giants

According to The Kobeissi Letter, it now takes six Nvidias to match gold's market cap. What's even more impressive is that gold has added roughly $833 billion per month over the past year - a pace no other asset has matched.

Currently trading at $4,117 per ounce with nearly a 3% gain this month, gold's upward trajectory shows no signs of slowing.

The comparison with market leaders reveals gold's overwhelming dominance:

- Gold leads at $27.6T with steady growth

- Nvidia follows at $4.58T, fueled by AI momentum but still dwarfed by gold

- Microsoft ($3.80T) and Apple ($3.67T) remain tech powerhouses yet can't compete with gold's scale

- Alphabet sits at $2.93T with waning comparative influence

- Silver quietly climbs to $2.83T, up 6.6% this month

- Bitcoin rounds out the top assets at $2.28T, though with characteristic volatility

What's Driving the Surge

Gold's remarkable rise stems from multiple converging factors. Persistent inflation has investors seeking reliable hedges, while central banks - especially in emerging markets - are buying at record levels. Geopolitical tensions continue escalating globally, making safe havens more attractive. Additionally, growing concerns about fiat currencies amid mounting debt and shifting monetary policies have renewed interest in tangible assets.

What This Means for Investors

This shift reflects a deeper change in market psychology. Long-term investors are benefiting from gold's wealth preservation qualities, while short-term traders still chase tech volatility despite gold's proven resilience. Portfolio managers are increasingly rebalancing toward precious metals as protection against uncertainty.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah