● Goldman Sachs recently published a bold forecast suggesting gold could hit $4,900 per ounce by late 2026. According to Stock Sharks, this projection is driven by strong central bank buying, rising geopolitical uncertainty, and gold's traditional role as protection against inflation and currency swings.

● There are real risks to consider though. If gold climbs too fast, some worry about speculation getting out of hand. A shift in monetary policy or higher real interest rates could quickly change the game, potentially triggering sell-offs that hit leveraged investors hard and send shockwaves through commodity markets.

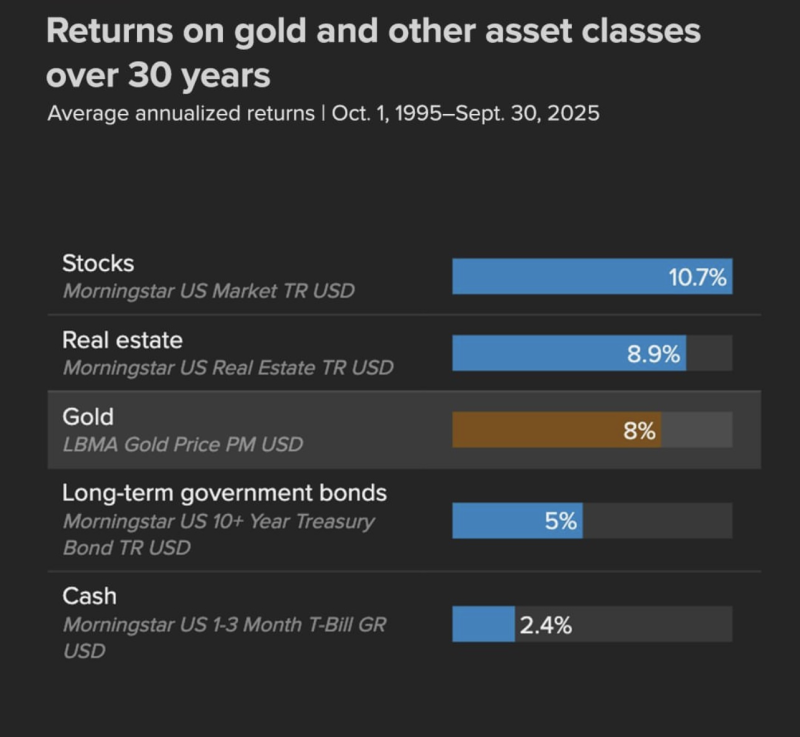

● Looking at the numbers, gold has returned about 7.96% annually over the past 30 years, based on Morningstar data. That's solid, but it trails the S&P 500's 10.67% and real estate's 8.89%. Still, it beats long-term government bonds at 5% and cash at 2.4%. Most investors have traditionally leaned into stocks for growth while keeping some gold as a stabilizer.

● If Goldman's target plays out, we could see real changes in how portfolios are built, potential increases in capital gains tax collections, and shifts in how countries manage their reserves. Gold seems to be evolving from just a safe-haven asset into something more strategic for growth-focused portfolios.

Usman Salis

Usman Salis

Usman Salis

Usman Salis