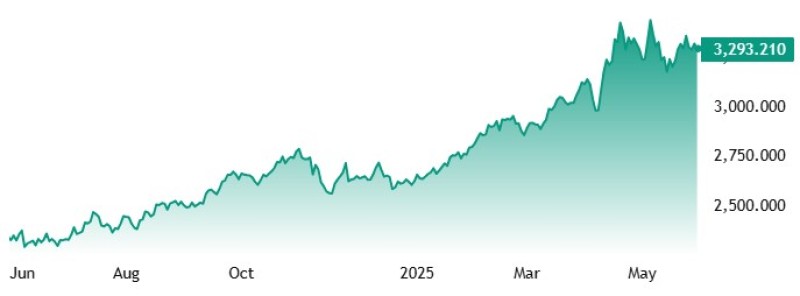

Gold (XAU) is hanging around $3,300 per ounce right now, and it's not looking pretty for the bulls. We're staring at a nearly 2% weekly drop because the US economy is way too strong for comfort, even though trade war drama should be sending this thing to the moon.

Why Gold (XAU) Can't Catch a Break Despite Strong Economy

Look, gold's in a weird spot right now. You'd think with all the trade war noise, people would be rushing to buy the shiny stuff, but that's not happening. And here's why - the US just dropped some seriously good economic numbers that nobody saw coming.

Personal income in April absolutely crushed expectations. We're talking way higher than anyone predicted. Consumer spending and inflation? Right on target. Sounds great, right? Well, not if you're holding gold.

Here's the thing that's killing gold bulls - when the economy looks this good, the Fed doesn't need to cut interest rates anytime soon. And Fed officials have been basically screaming this all week. They're saying "hey, we're comfortable keeping rates high for as long as we need to."

When rates stay high, gold becomes the ugly stepchild of investments. Think about it - why would you park your money in something that pays you nothing when you can get 5% in a savings account? It's a no-brainer, and that's exactly what's crushing gold prices right now.

Trade Wars Should Be Gold's (XAU) Best Friend, But Something's Off

This is where things get really crazy. Trump just came out swinging, saying China broke their trade deal with the US. He didn't spill all the details, but the message was crystal clear - we might be heading for Trade War 2.0 with the world's second-biggest economy.

And get this - Trump just won a huge court battle that cleared the way for his reciprocal tariff package. We're talking serious firepower here. The numbers are insane too - Trump's tariffs are going to bring in $152.7 billion in tax revenue this year alone. That's the biggest tax hike since 1993, and it's all coming from trade taxes.

Normally, this kind of chaos would send gold through the stratosphere. Traders usually treat gold like their security blanket when things get messy between superpowers. But that's not happening this time, and it's got everyone scratching their heads.

Since March, Trump has slapped 10% tariffs on basically everything we import, plus a brutal 145% tax on Chinese goods. You'd think this would have gold bugs dancing in the streets, but instead, they're watching their positions bleed.

The Real Reason Gold (XAU) Bulls Are Getting Wrecked

So what's really going on here? Why is gold acting like a dead fish when it should be swimming upstream? The answer is pretty simple - the dollar is still king, and when America's economy is crushing it, the dollar stays strong.

Gold and the dollar are like oil and water - they don't mix well. When one goes up, the other usually goes down. Right now, with the US economy firing on all cylinders, the dollar is flexing its muscles, and that's keeping gold in the penalty box.

Plus, let's be honest - the market has already been pricing in some of this trade war drama for months now. It's not like Trump's tariff threats came out of nowhere. The shock value just isn't there anymore.

The Fed is playing it smart too. They're saying they might cut rates twice this year, but that was before all this economic strength showed up. Now those rate cuts are looking less likely, especially if trade wars start pushing inflation higher. It's like trying to thread a needle while riding a roller coaster.

What's Next for Gold (XAU) - The Bulls' Last Hope

Here's what gold traders need to watch like their life depends on it. First, any real escalation in this trade war mess. If Trump actually follows through on more aggressive tariffs or if China hits back hard, we could finally see that safe-haven buying kick in.

The current gold price is sitting at $3,297.48 as of today, which is basically where we started this whole conversation. That tells you everything - gold is stuck in neutral, waiting for something big to happen.

Second thing to watch? Fed speak. Every word that comes out of Powell's mouth matters right now. The Fed kept rates steady but left the door cracked open for cuts later this year if inflation keeps cooling down. But with the economy looking this strong, that door might slam shut pretty quick.

Trump's 145% tariffs on China are already reshaping how the whole world does business. If this keeps escalating, we could see some serious economic disruption that finally gives gold the catalyst it's been waiting for.

Right now though? Gold bulls are stuck in purgatory. All the ingredients for higher prices are there - trade wars, geopolitical mess, and eventually the Fed will have to cut rates. But timing is everything in this game, and the timing just isn't right yet.

The strong economic data is acting like kryptonite to gold's Superman powers. When that data finally starts to crack, or when this trade war really starts hurting, that's when gold might finally break out of this funk. Until then, it's going to be a waiting game, and patience isn't exactly what most traders are known for.

Peter Smith

Peter Smith

Peter Smith

Peter Smith