If you're trading gold today, pay attention to what's happening on the charts. The latest technical analysis for Comex gold futures is showing some solid entry and exit points that could make your day.

This 5-minute bar chart analysis is designed for active intra-day traders who need to know where gold might bounce or break. The approach is simple: buy on early price strength and sell on early price weakness. Timing these moves is where money gets made, and that's what this analysis helps you nail down.

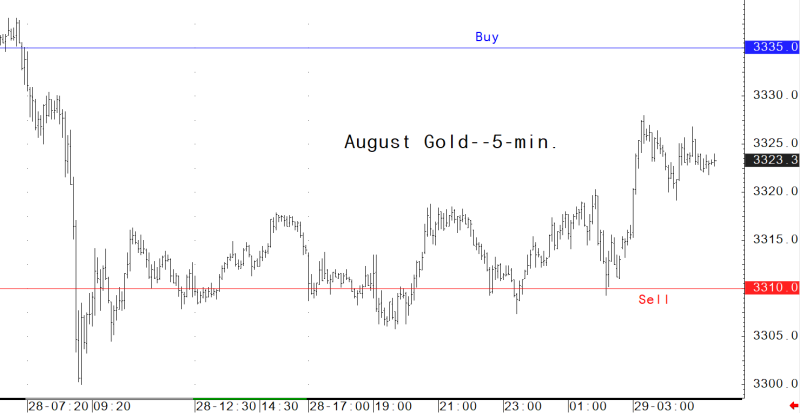

Gold (XAU) Support and Resistance Levels

Gold trading is all about key levels where the metal bounces or breaks through. Today's 5-minute chart shows specific price points where you might want to get ready to act.

These aren't random lines on a chart – they're actual price zones where buying and selling pressure shifts. Using 5-minute charts lets you catch quick moves throughout the day, especially when news hits or sentiment changes fast.

Gold (XAU) Price Entry Points for Traders

If you're day trading gold, this technical breakdown is essential. The analysis shows specific price levels to watch – actual numbers where you can set alerts, not vague predictions.

The strategy is straightforward: when gold shows early strength at support, consider going long. See early weakness at resistance? Time to short or take profits. Professional traders position themselves early when they spot momentum building.

This focused analysis takes the guesswork out of gold trading. Instead of hoping for the best, you're working with solid technical signals. The gold market rewards traders who know what they're doing, but it'll humble you quickly if you're just winging it. Having a systematic approach gives you a real edge.

Usman Salis

Usman Salis

Usman Salis

Usman Salis