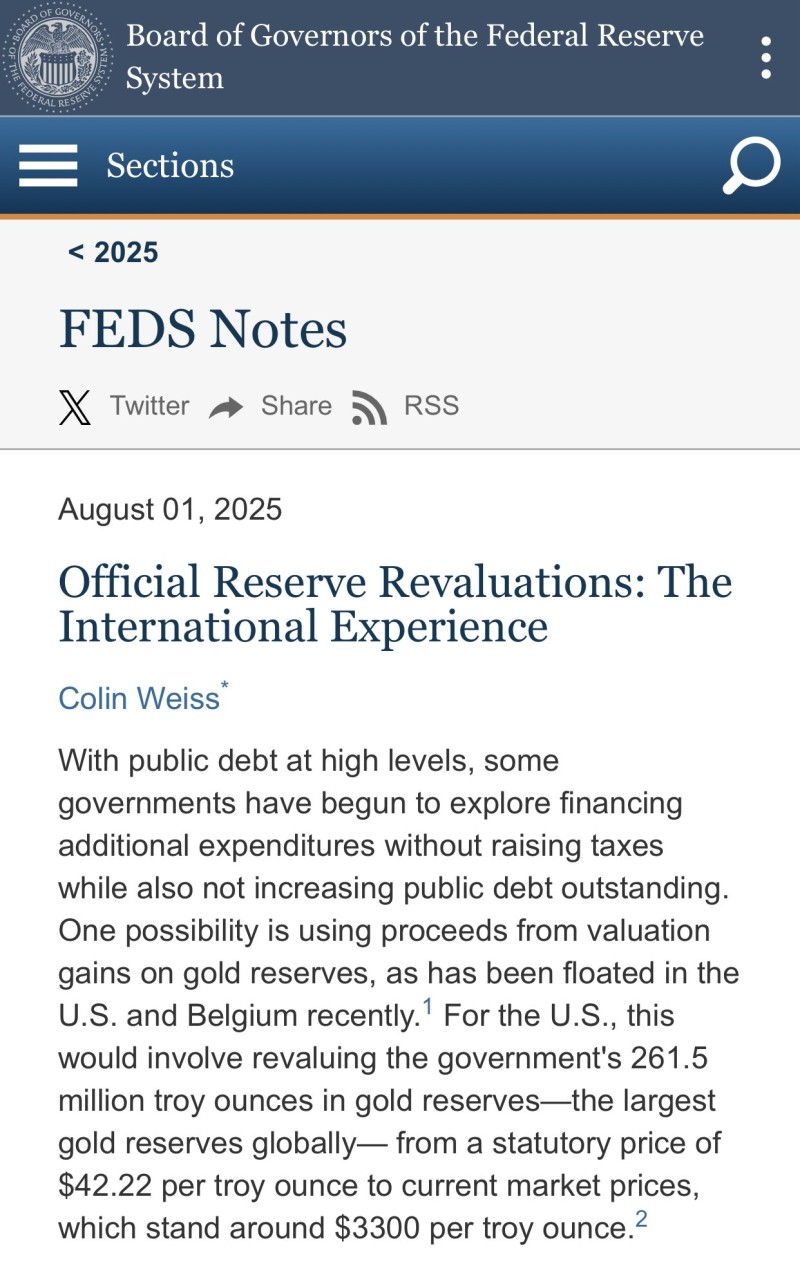

The Federal Reserve just dropped a bombshell in its August 1, 2025 FEDS Notes publication. Written by Colin Weiss, the paper discusses something that would've been unthinkable just years ago: revaluing America's gold reserves to help tackle mounting government debt without raising taxes or borrowing more money.

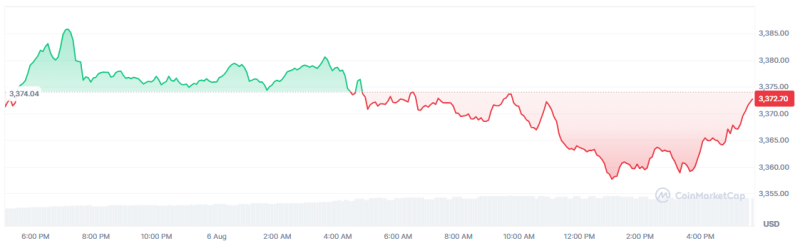

Here's where it gets interesting. The U.S. currently values its 261.5 million troy ounces of gold at a statutory price of just $42.22 per ounce. But with gold (XAU) trading around $3,372 today, that's sitting on over $860 billion in unrealized value. The Fed is basically admitting they've been cooking the books on their balance sheet for decades.

Gold (XAU) Price Exposes Real Inflation Story

What really caught people's attention wasn't just the revaluation talk — it was what this reveals about the dollar's true performance. A viral tweet summed it up perfectly:

"Interesting timing, and an admission the USD has fallen from 1/42 oz to 1/3300 oz of gold in the past 54 yrs, a CAGR of 8.4% (which, since everyone suddenly cares about economic data accuracy, is MUCH higher than the official reported US inflation rate of the past 54 years.)"

Think about that for a moment. While the government's been telling us inflation runs around 2-3% annually, gold (XAU) has been screaming a different story. That 8.4% compound annual growth rate in gold prices suggests the real purchasing power erosion has been much steeper than official statistics admit.

Why Gold (XAU) Revaluation Could Change Everything

This isn't just accounting wizardry. If the U.S. moves forward with revaluing its gold reserves, it could trigger a domino effect globally. Other countries might follow suit, suddenly making their own gold stockpiles look a lot more valuable on paper.

Belgium's already having similar discussions, according to the Fed note. And if multiple major economies start treating gold (XAU) as more than just a dusty relic in their vaults, we could be looking at a fundamental shift in how the global monetary system operates.

The bigger question is whether this signals a loss of confidence in pure fiat currencies. When central banks start seriously discussing gold revaluation after decades of dismissing it, that tells you something about where they think the financial winds are blowing.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah