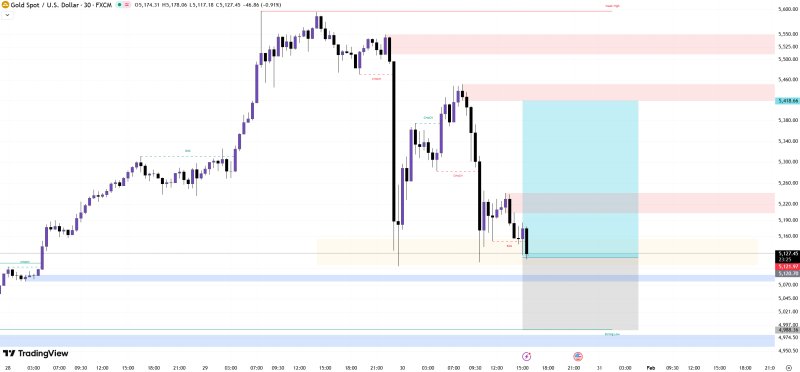

⬤ Gold took a breather on XAU/USD after the U.S. dollar flexed its muscles, triggering some profit-taking following a solid rally. The 30-minute chart shows gold pulling back from recent highs near the upper resistance zone, sliding down toward the $5,120 level. Even with this dip, the broader picture still favors gold thanks to economic uncertainty and steady demand for hard assets.

⬤ The chart reveals gold's aggressive push higher before hitting a wall at resistance, followed by a sharp reversal that broke short-term support levels. Price then found its footing near a lower demand zone, hinting at a pause rather than a full-blown trend change. This kind of action typically happens when the dollar strengthens after being weak for a while—it's more about temporary positioning than fundamental shifts.

⬤ The bigger story behind gold remains tied to policy confusion, concerns about fiscal spending, and simmering geopolitical tensions. Fresh geopolitical worries—particularly U.S. pressure on Iran—have pushed oil higher and reminded everyone why gold matters as a safety play. These factors usually keep a floor under XAU/USD even when short-term moves create noise.

⬤ Why this matters: Gold acts as a real-time barometer for confidence in monetary policy, geopolitical stability, and tangible asset demand. When gold bounces back after pullbacks, it shapes expectations around volatility and where the trend might head next. How price behaves at critical support and resistance levels can ripple across commodities and currencies, especially when global uncertainty runs high.

Peter Smith

Peter Smith

Peter Smith

Peter Smith