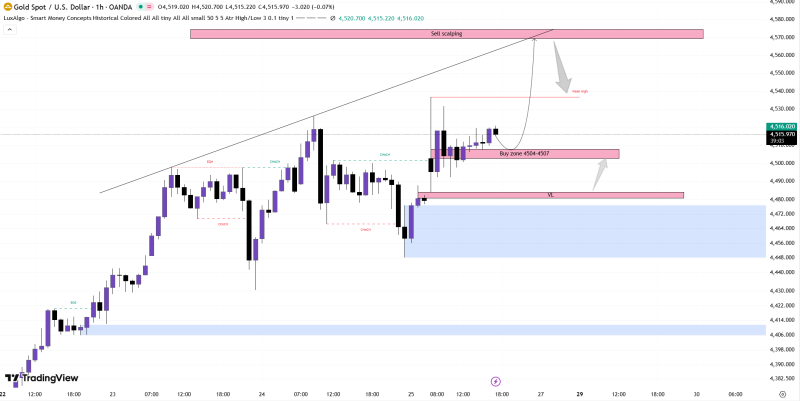

⬤ Gold continues consolidating after its recent run-up, with traders zeroing in on potential pullback levels. The 4504–4507 zone is now being monitored as a reasonable "repricing" area where buyers might look to jump back in if price softens. Current charts show XAU/USD still trading above this support region, suggesting the market is holding near recent highs while participants wait to see if a corrective dip materializes.

⬤ The 4504–4507 band represents both a technical pullback target and a preferred entry point for long positions. The thinking is straightforward: Gold has already made a meaningful move higher, and a retracement toward this zone would help rebalance price before any further upside attempts. As long as Gold stays above that threshold, the outlook remains constructive.

⬤ That conditional approach reflects a disciplined, rule-based style—tying execution to how price actually behaves around the specified level rather than assuming an automatic bounce. If Gold breaks below 4504, the plan shifts to waiting for stabilization at deeper support before re-entering.

⬤ This matters because XAU/USD remains a closely watched macro asset, often swayed by shifts in sentiment, yields and risk appetite. Clear technical levels like 4504–4507 help define risk and opportunity during consolidation. Whether Gold holds above that zone or slips lower could shape near-term momentum in precious metals and influence how traders position for the next directional move.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova