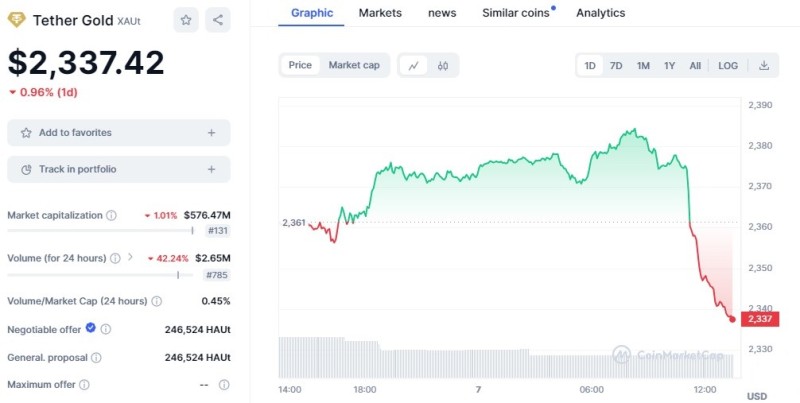

Analysts at Metals Focus predict that gold prices will hit new record highs in the second half of 2024, driven by potential monetary policy easing from the Federal Reserve.

XAU Prices Poised for New Record Highs

Gold prices are once again testing resistance levels near $2,400 an ounce, with analysts at Metals Focus forecasting that the precious metal will reach new all-time highs in the second half of 2024. According to their latest report, the anticipated monetary policy easing from the Federal Reserve is expected to be a significant driver behind this surge.

In their weekly note published Thursday, Neil Meader, Director of Gold and Silver at Metals Focus, emphasized the impact of the Federal Reserve’s potential policy changes on gold prices. “Later this year, we expect prices will rise again, with a new all-time high likely,” Meader stated. He noted that the recent peak of $2,450, in real terms, is still lower than the 1980 peak, which would be approximately $3,000 in today’s dollars.

Forecast and Market Expectations for XAU

With a new record peak anticipated, Metals Focus projects that gold prices will average around $2,250 an ounce for the year, marking a 16% increase from last year’s record average price. This optimistic outlook comes amid disappointing economic data and increasing slack in the U.S. labor market, which have heightened expectations for the Federal Reserve to begin a new easing cycle by September.

Even if the Federal Reserve maintains its current aggressive monetary policy, Metals Focus analysts see limited downside for XAU for the remainder of the year. Several factors are contributing to this bullish outlook. An insatiable demand from global central banks, a bleak global fiscal outlook, ongoing geopolitical tensions, and a weakening Chinese economy have all played pivotal roles in bolstering gold prices.

Geopolitical and Economic Influences

Meader highlighted that geopolitical uncertainties, such as conflicts in the Middle East and Ukraine, alongside persistent US/China tensions, are unlikely to be resolved soon. These factors, combined with the physical markets adapting to higher prices, are expected to improve gold's fundamentals significantly. “Whether they start this year or next, US rate cuts are coming,” Meader added, pointing to the inevitability of monetary policy shifts in favor of XAU.

In conclusion, as the year progresses, the combination of economic, geopolitical, and market factors suggests a strong bullish trend for gold. With predictions of new record highs and an average price of $2,250 an ounce, investors and market watchers will be closely monitoring the Federal Reserve's actions and global events that could drive the precious metal's value even higher. Metals Focus' analysis provides a comprehensive outlook on why gold is poised for significant gains in 2024.

Usman Salis

Usman Salis

Usman Salis

Usman Salis