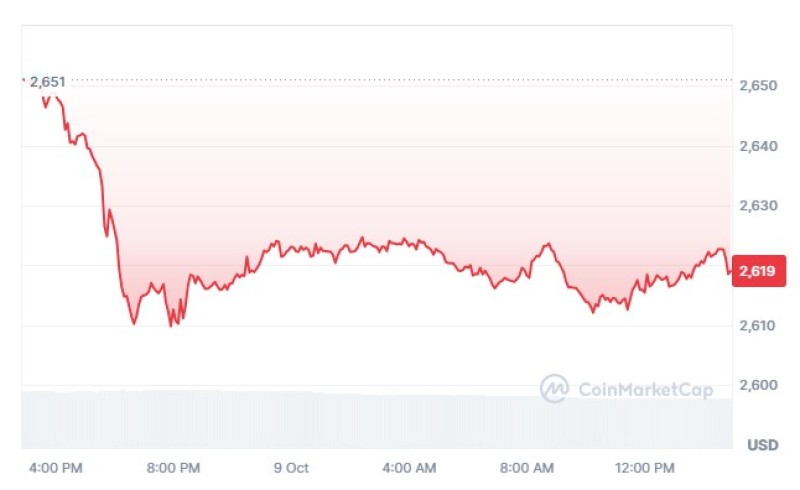

Gold price (XAU) continues its decline, falling below $2635.06, with the next support level set at $2578.65 as the market faces correction pressure.

Gold price (XAU) experienced a sharp downturn yesterday, closing below the critical $2635.06 level. This drop is significant as it activated the negative effects of the double top pattern, which has intensified bearish sentiment in the market. The downward pressure is expected to continue in the upcoming sessions, as traders now eye a potential break below $2603.87. Should this level be breached, the next correctional target for gold is projected at $2578.65, signaling a further decline in the short term. This development was reported by News.Az, citing The Economiies.

Gold Price (XAU) Falls Below $2635.06: Bearish Momentum

The fall of the gold price below $2635.06 has confirmed the activation of the double top pattern, a bearish technical formation. This pattern has triggered a wave of selling pressure, further amplifying the negative outlook for gold in the near term. The persistent downward trend suggests that the market could see more declines if the price fails to reclaim this level. A key factor to watch is whether the gold price can breach $2603.87, a crucial support level that, if broken, will open the door for a deeper correction.

With the negative momentum building up, the next significant support level for gold (XAU) is $2578.65. This price level represents the next correctional station as the metal continues to face downward pressure. If the gold price fails to hold above $2603.87, reaching this support could signify a more extended correction phase. Traders and investors should closely monitor this level, as it may serve as a decisive point for the continuation of the bearish trend.

Conditions for Reversal in Gold Price (XAU) Movement

Although the current sentiment around gold is negative, a breach of the $2635.06 resistance level could halt the bearish scenario. If gold (XAU) manages to break above this level, it may signal a shift back toward the bullish track, potentially leading to a recovery. For now, however, the trend remains focused on the downside, with bearish pressure dominating the market outlook.

The expected trading range for gold today is between $2590.00 as support and $2635.00 as resistance. This range will be a critical zone for traders looking to capitalize on the current volatility in the gold market. If gold (XAU) remains within this range, it could provide opportunities for short-term gains, but any decisive break beyond these levels will likely dictate the next significant move in the market.

Conclusion

Gold price (XAU) is under considerable pressure as it heads towards the $2578.65 correction level. The bearish momentum remains strong, but a break above $2635.06 could reverse the trend. For now, traders are advised to keep an eye on key support and resistance levels to navigate this volatile market effectively.

Usman Salis

Usman Salis

Usman Salis

Usman Salis