The relationship between fiat currencies and precious metals often tells a compelling story about economic health and monetary policy effectiveness. Recent analysis of the British pound's performance against gold over the past 17 years reveals a troubling trend that has significant implications for UK savers and investors. This dramatic shift highlights how traditional currency holdings have fared against one of history's most trusted stores of value.

Long-Term GBP Collapse Against Gold

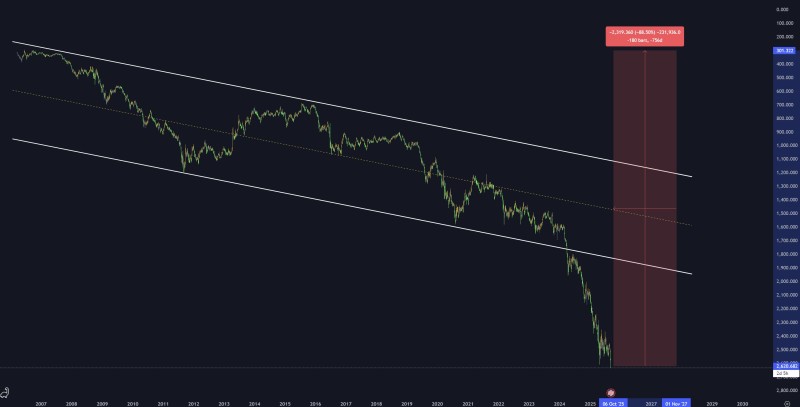

Market analyst recently shared an eye-opening chart showing how the pound has performed against gold, presented in an inverted format for better clarity. While the chart might look like a strong upward trend at first glance, the reality is much more sobering - it shows how much less gold each pound can buy today compared to 2007.

The numbers are stark: the pound's buying power for gold has dropped by nearly 90% over almost two decades. This massive decline shows just how much inflation and questionable economic policies have hurt regular people's savings.

Gold (XAU) Price Demonstrates Resilience as Fiat Weakens

Gold has always been seen as protection against currency devaluation, and this comparison proves that point perfectly. While the pound has steadily lost ground, gold has maintained its value and purchasing power.

Right now, the pound is trading near the bottom of a long-term downward trend against gold. This suggests we might see even more weakness ahead unless the UK makes some serious economic changes.

Implications for Investors and UK Households

This 88.5% drop since 2007 should be a wake-up call for anyone holding pounds as their main savings. Regular cash savings have been getting crushed while gold has held strong as a reliable store of wealth.

Many analysts now say it's crucial to spread investments across different assets, especially gold and other hard assets, to protect against this kind of currency decline. Without major changes to how the UK handles its finances, the pound could keep losing value, leaving savers in an even worse position.

Peter Smith

Peter Smith

Peter Smith

Peter Smith