Gold price (XAU/USD) maintains a mild positive bias as attention turns to the release of US Consumer Price Index (CPI) and Retail Sales data.

XAU Price Gains Momentum Amid Investment Demand

- US Producer Price Index (PPI) Data. The US Producer Price Index (PPI) showed a 2.2% year-over-year (YoY) rise in April, surpassing March's 1.8% increase and meeting expectations. Additionally, the Core PPI surged by 2.4% YoY in April, compared to a 2.1% increase in March. Both the PPI and Core PPI rose by 0.5% month-over-month (MoM) in April.

- Fed's Stance on Inflation. Fed Chair Jerome Powell noted that inflation is receding slower than anticipated, citing the PPI data as further justification for maintaining higher interest rates for an extended period. Powell indicated that additional rate hikes may not be necessary. Kansas City Fed President Jeffrey Schmid expressed concerns over persistently high inflation, suggesting ongoing efforts by the US central bank.

- US CPI and Retail Sales Outlook. Analysts project a slight moderation in annual headline Consumer Price Index (CPI) inflation to 3.4% for April from the initial estimate of 3.5%. Similarly, Core CPI inflation is expected to decline to 3.6% in April from the previous 3.8%. Retail Sales in the US are forecasted to decrease to 0.4% MoM in April from the preliminary reading of 0.7%.

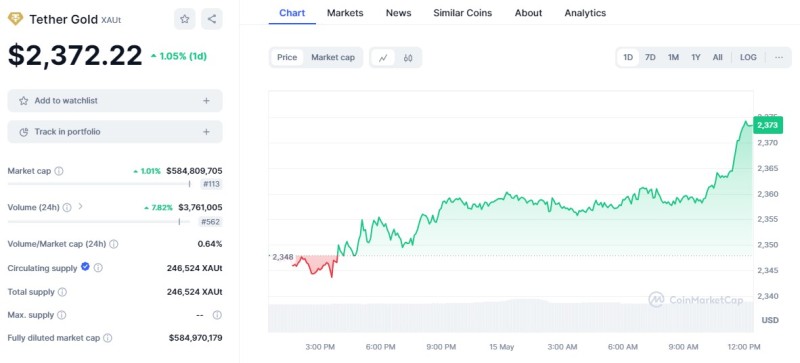

- Market Expectations and XAU Demand. Financial markets currently imply a 65% probability of a Fed rate cut in September 2024, according to CME's FedWatch Tool. Meanwhile, global gold demand surged by 3% to 1,238 tonnes in Q1 2024, marking the strongest first quarter since 2016, as reported by the World Gold Council.

Positive Outlook for XAU Price

Technical analysis indicates a favorable outlook for gold, with the yellow metal trading positively above the key 100-period Exponential Moving Average (EMA) on the four-hour chart. The 14-day Relative Strength Index (RSI) remains bullish at 60.70, suggesting upward momentum.

In conclusion, the XAU trajectory hinges on the release of US CPI and Retail Sales data, with market participants closely monitoring inflation trends and consumer spending patterns. Despite potential headwinds from Fed officials' hawkish remarks, gold's positive stance and technical indicators indicate resilience in the face of market dynamics.

Peter Smith

Peter Smith

Peter Smith

Peter Smith