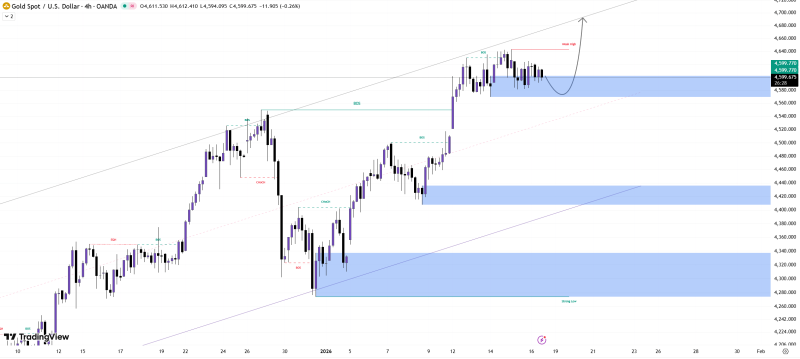

⬤ Gold is hanging tight above a crucial short-term support zone, with the 4-hour chart showing some sideways action after a solid rally. XAU/USD is stabilizing above the $4,570–$4,590 area, which has been holding as a key demand zone following the recent push higher. As long as price stays above this range, the bullish short-term outlook remains alive and well.

⬤ The chart paints a pretty clear bullish picture, backed by several breaks of structure during the climb. After pushing into the mid-$4,600s, gold shifted into consolidation mode instead of rolling over. This pause is happening right above former resistance levels that have now flipped into support, which reinforces the strength of the move. Price action is contained within a defined range for now, showing some balance while the broader upward structure holds firm.

⬤ According to the scenario laid out, a clean break and hold above $4,620 would confirm that the bulls are still in control. The chart projects potential expansion toward the $4,670–$4,700 zone if that breakout happens. While some short-term dips within the consolidation are possible, the overall structure still favors higher prices as long as gold stays above that highlighted support zone.

⬤ This matters because gold is sitting at a critical decision point after an extended run higher. Consolidation above support suggests strength rather than weakness, keeping the short-term bullish bias intact. A confirmed breakout would reinforce positive momentum and trend continuation, while losing support would signal a shift in near-term structure and change the directional outlook.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets