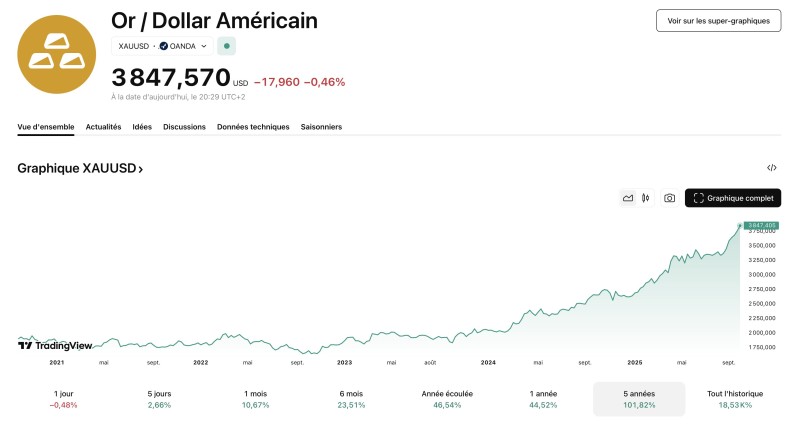

Gold has proven itself as the go-to safe haven with a stunning five-year run. Starting from under $1,900 in 2020, the precious metal has now touched $3,847 per ounce—a massive 101.7% jump that's caught everyone's attention.

What's Driving This Rally

According to Cerfia's recent analysis, this record-breaking move stems from stubborn inflation and growing global uncertainty. As geopolitical tensions heat up and monetary policy remains unpredictable, gold's momentum has pushed into uncharted territory.

Multiple factors are behind gold's impressive climb:

- Inflation protection – Even with central banks raising rates, persistent inflation keeps gold attractive as a value store

- Global tensions – Rising conflicts and uncertainty worldwide have sparked increased safe-haven buying

- Central bank buying – Countries are stockpiling gold to reduce dependence on the dollar

- Rate cut expectations – Markets anticipating eventual policy easing have softened real yields, supporting prices

This combination has made gold one of the decade's top-performing major assets. The TradingView chart shows a steady climb from the 2020 lows, with a consolidation phase between $2,000-$2,500 during 2023-2024 before the recent breakout. The latest surge blasted through $3,500 resistance, with momentum indicators showing a 23.5% gain over six months and 46.5% over the past year.

What's Next

At $3,847, the big question is whether gold can keep climbing. If inflation stays sticky and geopolitical risks continue, the psychological $4,000 level looks like the next target. On the flip side, a stronger dollar or unexpectedly hawkish central bank moves could trigger a pullback toward $3,500 support.

Whatever happens short-term, gold's position as a core hedge looks more solid than ever. This historic move—doubling in value over five years—represents a generational shift in how investors view the precious metal, and with uncertainty still running high, XAU remains firmly in the spotlight.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah