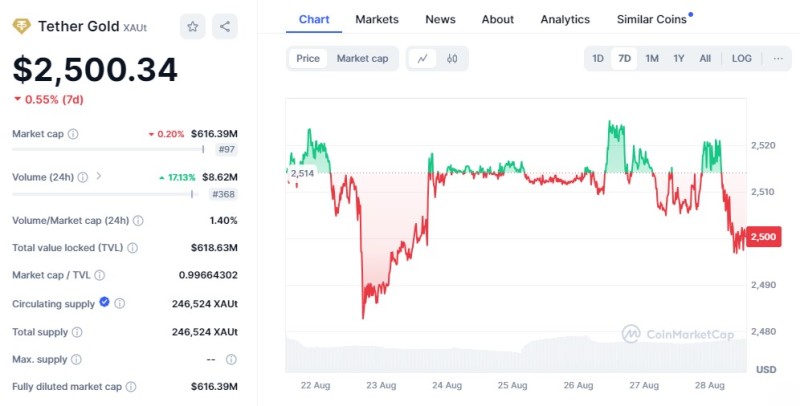

Gold futures (XAU) have reached an all-time high of $2,560, driven by a weakening U.S. dollar and shifting economic factors, solidifying gold's status as a reliable store of value.

Gold Futures (XAU) Reach New Record High

In a remarkable turn of events, gold futures have surged to an all-time high of $2,560.00, marking a significant milestone in the precious metals market. This record-breaking achievement, featuring a $6.40 or 0.25% gain in the most active December contract, highlights the ongoing strength and appeal of gold as a safe-haven asset.

The recent rally in gold prices is closely tied to the ongoing decline of the U.S. dollar. Early Tuesday trading saw gold experience a brief dip as short-term traders locked in profits from previous gains. However, the market quickly rebounded, buoyed by a persistent decline in the dollar and renewed interest from investors eager to capitalize on the dip.

Economic Indicators Influence Gold Futures Performance

The rise in XAU prices comes against the backdrop of improving consumer sentiment, as reflected in the latest Consumer Confidence Index for August. The index showed a slight increase, with the current assessment rising to 134.4 from 133.1 in July. Similarly, the Expectations Index, which measures consumers' short-term outlook, also saw a modest uptick, further supporting the positive market sentiment.

A key factor contributing to the dollar's recent decline is the growing anticipation of a shift in the Federal Reserve's monetary policy. Optimism surrounding the Fed's potential pivot towards interest rate normalization has been building since late June, and was further solidified by Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole Economic Symposium. Powell's remarks confirmed that the era of aggressive interest rate hikes is coming to an end, with the first-rate cut likely to occur in September.

Market expectations, as reflected in the CME's FedWatch tool, now show a 66% probability of a 25-basis point cut in September, with a 34% chance of a more substantial 50-basis point reduction. These anticipated changes in monetary policy have bolstered the appeal of gold as a safe-haven asset, driving its price to unprecedented levels.

Conclusion

The record-breaking performance of gold futures (XAU) amid a weakening dollar and shifting economic conditions underscores the enduring value of gold as a store of value and a hedge against market volatility. As the Federal Reserve signals the end of its aggressive interest rate hikes, gold's appeal is likely to remain strong, solidifying its role as a critical asset in uncertain economic times.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah