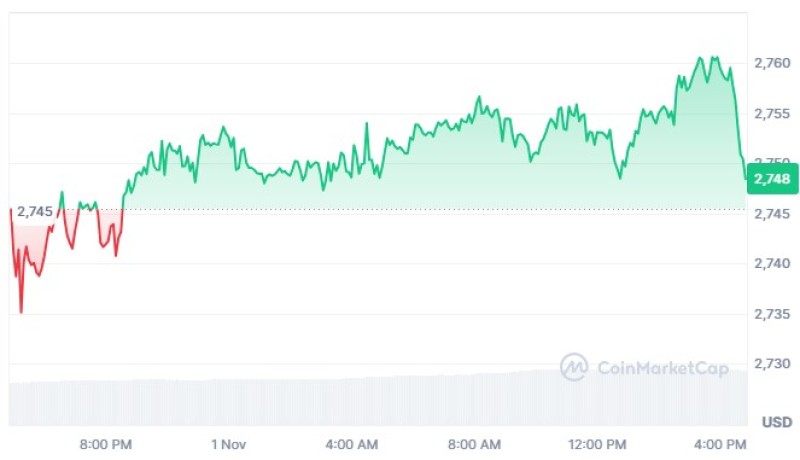

Gold (XAU) dips below $2750 as traders take profits, with silver (XAG) and platinum (XPT) facing pressure. Key support levels may signal further market shifts.

Gold Slips Below $2750 as Traders Take Profits

Gold (XAU) recently dropped below the critical $2750 mark as traders locked in profits after a strong rally toward historic highs. This pullback highlights the volatility in precious metals, where rapid price movements often trigger profit-taking. As gold continues to lose ground, analysts are closely watching support levels to assess if the bearish momentum will continue.

Currently, if gold holds below $2715, it could be set to decline further towards the next major support zone between $2675 and $2685. This range represents a key technical area where buying interest may emerge, providing potential stability amid the current dip. A breach below this level could signal increased selling pressure, adding to gold's recent losses.

Silver (XAG) Faces Sharp Decline as Gold-Silver Ratio Rises

Silver (XAG) also experienced a sharp decline, dropping more than 3% in the wake of gold’s sell-off. The gold-to-silver ratio has moved above 83.50, indicating silver's underperformance relative to gold. If silver maintains a position below the $33.00 mark, it may continue its descent, with a critical support range at $31.45 to $31.75 providing a potential safety net for the metal’s price.

Platinum Under Pressure with Broader Precious Metals Market Weakness

Platinum has not been immune to the broader sell-off in precious metals, testing new lows in recent trading sessions. From a technical standpoint, platinum’s price momentum will likely hinge on its ability to hold above the support range of $975 to $985. A move below this threshold could increase the downside momentum, further pressuring the metal as investor sentiment remains cautious across the sector.

Technical Outlook and Market Implications

The current moves in gold, silver, and platinum suggest that traders may be recalibrating their positions in light of recent gains. If profit-taking continues, these metals could see additional declines, especially if critical support levels are breached. Market participants are advised to keep an eye on these levels as they may influence broader trends in the precious metals market.

Usman Salis

Usman Salis

Usman Salis

Usman Salis