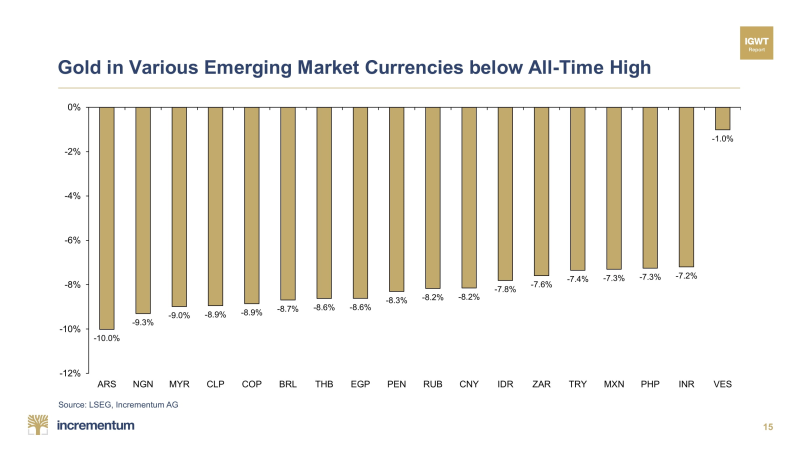

⬤ Gold has fallen from its latest record highs quoted in emerging market currencies. A rapid surge had lifted XAU to never seen prices in almost every one of those markets, but a late month reversal peeled those prices back from the peaks. The abrupt change contrasted with September, when 17 of 18 monitored EM currencies had already reached historic highs against gold.

⬤ The retreat struck the whole EM group right away. Venezuela's bolivar dropped about 1 %, while Argentina's peso fell close to 10 %. Nigeria's naira Malaysia's ringgit, Chile's peso, Colombia's peso, Brazil's real, Thailand's baht, Egypt's pound, Peru's sol, Russia's ruble, China's yuan, Indonesia's rupiah, South Africa's rand, Turkey's lira, Mexico's peso, Philippines’ peso besides India's rupee each gave back between 7 % and 9 %. The quick and sweeping decline shows that sentiment flipped soon after the earlier climb - none of the emerging market currencies kept their gold linked record levels.

⬤ The simultaneous drop matters. When gold leaps or falls across many EM currencies at once, it normally points to shifting liquidity or to macro pressures inside those economies. The broad retreat from all time highs indicates that the global gold market is recalibrating. The way EM currencies respond will shape expectations for XAU's next move as traders review their positions after the volatility.

Peter Smith

Peter Smith

Peter Smith

Peter Smith