The Outlook on the Market

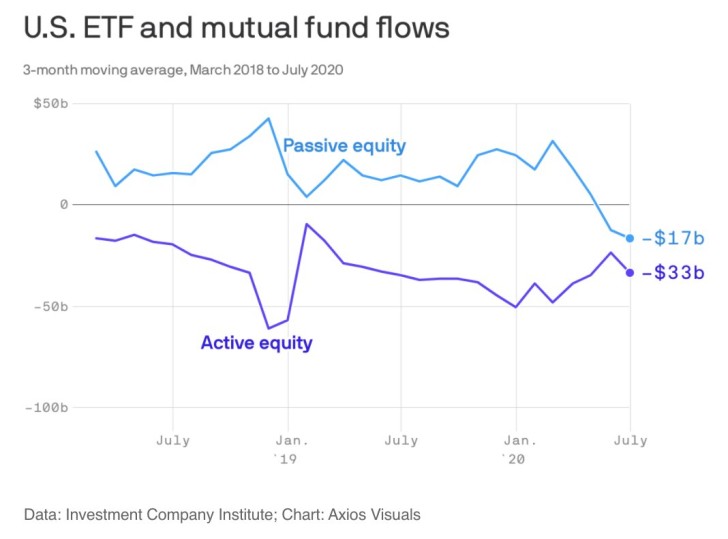

Outflows are being noticed also by dynamically controlled mutual funds and ETFs. Investment Business Institute’s analysis reveals over $17 billion a month in the last three months, quitting passive investments, something that has never occurred before.

A lot of passive capital frequently is equal in target-date funds. The stock market recovery may have pressured certain funds to sell those equities just to retain the target amount of their overall equity portfolio.

Irrational Market

According to Holger Zschaepitz, it is a big paradox that ETF sales are increasing, instead of increasing purchases and portfolios on the contrary.

Monthly contributions from actively managed mutual funds were negative for several years and although passive fund contributions were positive, usually they were lower.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi