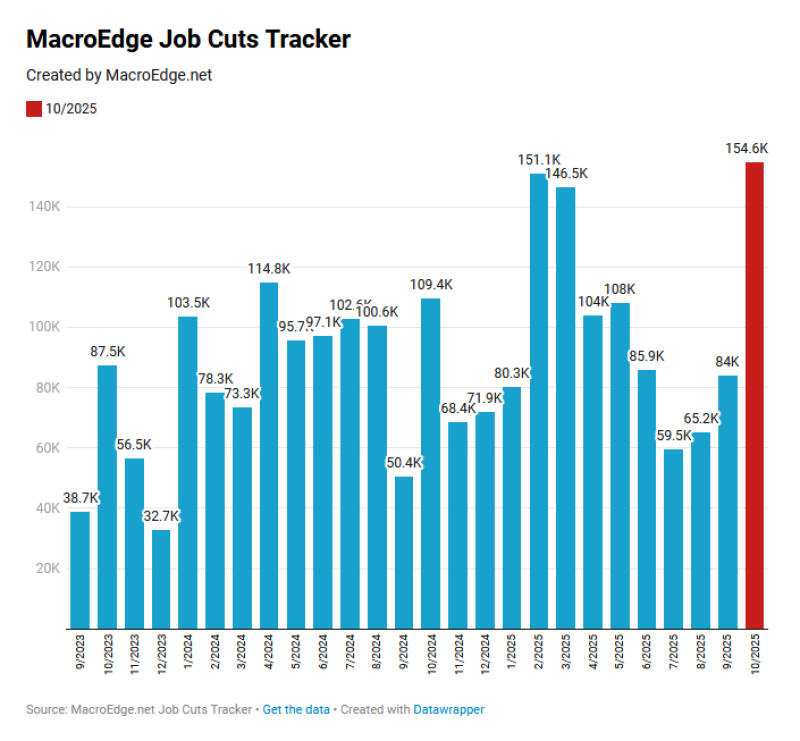

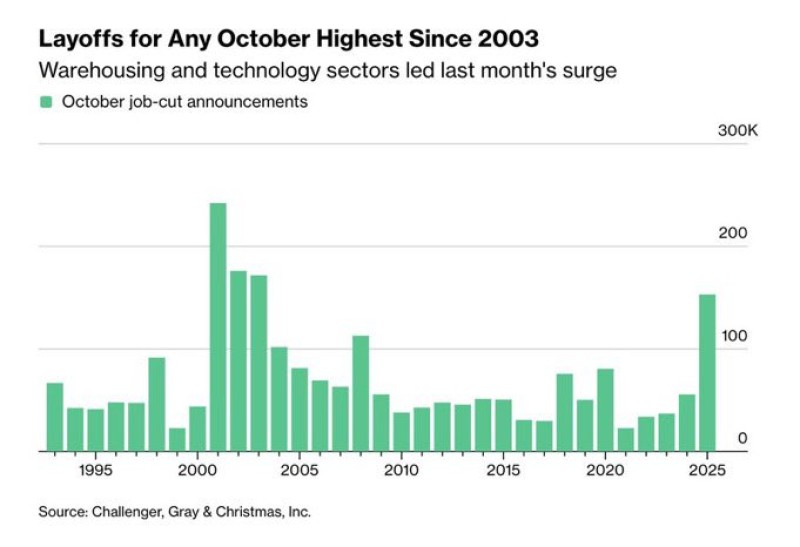

● American employers slashed 153,074 jobs in October 2025, representing a staggering 183% jump from September and a 175% increase from October 2024, according to data from Challenger, Gray & Christmas. It's the worst October for layoffs since 2003—a time when another disruptive technology was reshaping the economy.

● Through the first ten months of 2025, companies have announced 1,099,500 job cuts, marking a 65% spike from the same period last year and the highest level since the pandemic-driven crisis of 2020. The numbers have some economists dusting off the "R-word."

● Cost-cutting tops the list of reasons, with over 50,000 layoffs attributed to this factor in October alone. But there's more to the story. Andy Challenger, chief revenue officer at the outplacement firm, notes that companies are adjusting after pandemic-era hiring booms while simultaneously embracing AI adoption—a combination that's driving both belt-tightening and hiring freezes.

● The technology sector led the charge with 33,281 cuts in October—nearly six times September's figure—bringing the year's total tech layoffs to 141,159, up 17% from 2024. Warehousing saw a dramatic spike too, with 47,878 jobs eliminated in October as automation and overcapacity catch up with pandemic-era expansion. Retail, services, and consumer products are also getting hammered as shifting habits, cost pressures, and store closures reshape the employment landscape.

● Challenger called the timing of these fourth-quarter cuts "particularly cruel," noting that social media now amplifies workers' experiences of being laid off right before the holidays. "At a time when job creation is at its lowest point in years, the optics of announcing layoffs in the fourth quarter are particularly unfavorable," he said.

● The layoff levels mirror patterns typically seen during recessions, with year-to-date cuts at their highest since the pandemic. Planned hiring has dropped 35% compared to 2024, hitting the lowest year-to-date total since 2011. Despite the mounting cuts, the broader economy hasn't tipped into full recession—consumer spending remains positive and corporate earnings are above crisis thresholds. But some analysts view this as a "corrective recession"—a retrenchment in hiring and wages rather than a complete contraction.

● For workers caught in the crossfire, the message is clear: the job market is tightening, and finding new roles is taking longer. Whether this surge in cuts marks the beginning of a deeper downturn or simply a painful adjustment period remains to be seen—but the alarm bells are definitely ringing.

Usman Salis

Usman Salis

Usman Salis

Usman Salis