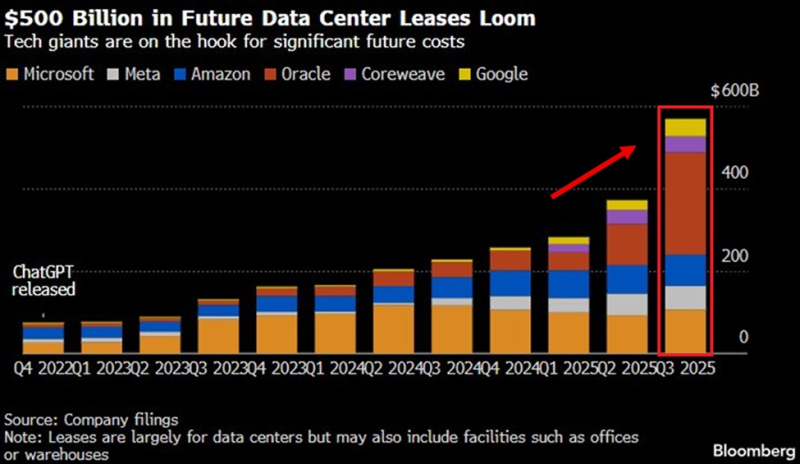

⬤ Tech companies in the U.S. are going all-in on AI infrastructure, signing long-term data center leases that now total around $569 billion. Looking at the numbers, there's been a dramatic jump starting in late 2022—right when AI investments started heating up. Most of these multi-year agreements are for data centers, though some also cover office space and warehouses. The scale of these commitments shows just how seriously companies are taking the AI race.

⬤ Company filings reveal a steady quarterly climb that really picks up steam through 2024 and into 2025, with projections heading toward $600 billion. These aren't purchases—they're rental agreements that lock companies into fixed payments for years to come. Compared to Q2 2025, total commitments have jumped by roughly $197 billion, a 53% increase. That rapid acceleration shows how AI demand is fundamentally changing the cost structure across the entire tech sector.

These lease commitments represent a fundamental shift in how tech companies are structuring their long-term operations—they're betting billions that AI infrastructure needs will only grow.

⬤ Oracle stands out with the biggest recent moves. In Q3 alone, the company added about $148 billion in new lease commitments, pushing its total data center obligations to around $248 billion. That's more than Microsoft, Amazon, Meta, Google, and CoreWeave combined during the same period. Some of Oracle's agreements stretch out 19 years, meaning the company is locked into these costs well into the 2040s—regardless of whether AI demand stays hot or cools off.

⬤ This matters because these massive, long-duration leases affect everything from cash flow to corporate flexibility. When companies commit hundreds of billions to AI infrastructure, their financial performance becomes tied to keeping those data centers running at high capacity for decades. With tech firms carrying historically high fixed obligations, any changes in AI adoption rates, pricing, or broader economic conditions could significantly impact earnings, balance sheets, and market confidence going forward.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova