⬤ Oracle's market value evaporated by $35 billion in just 48 hours after the company disclosed concerning details about its AI infrastructure strategy. What initially looked like a routine earnings disappointment quickly morphed into something more serious when analysts dug into the balance sheet. The real story wasn't about quarterly revenue—it was about how much financial risk Oracle was taking on to fuel its AI ambitions.

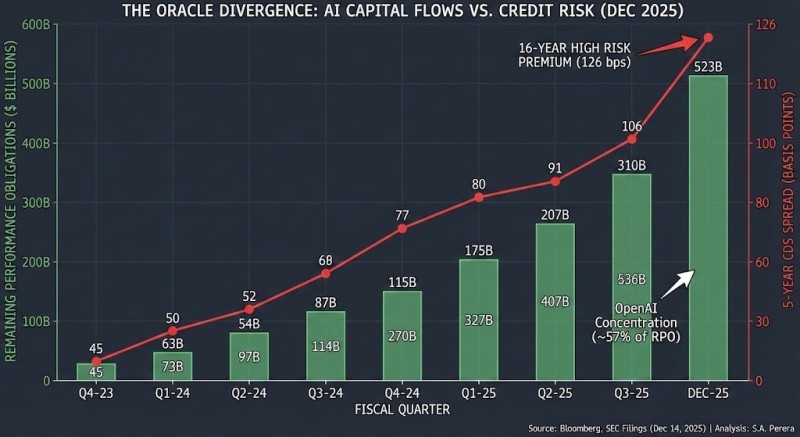

⬤ The bombshell came when Oracle revealed that 57% of its $523 billion in remaining performance obligations relies on one customer: OpenAI. That's an extraordinary concentration of risk for any company, let alone one of this size. Meanwhile, Oracle's five-year credit default swap spread jumped to 126 basis points, the highest it's been in over 16 years. Interestingly, other tech giants like Microsoft, Google, and Amazon didn't see similar credit stress during this same period, suggesting Oracle's situation is unique.

⬤ The financial dynamics paint a picture of what some are calling a circular AI economy. OpenAI commits to massive long-term compute contracts with Oracle, Oracle pours money into data centers and advanced chips, and NVIDIA supplies the critical hardware that makes it all possible. Despite strong demand signals, Oracle reported roughly $10 billion in negative free cash flow for the quarter. Building AI infrastructure at this scale isn't cheap—power requirements, cooling systems, and grid limitations are creating serious financial pressure.

⬤ What makes this particularly significant is the disconnect between what equity and credit markets are saying. Stock investors have been focused on AI growth potential, but credit markets are flashing warning signs about whether this expansion model is sustainable long-term. The widening gap between accelerating capital flows and rising credit risk suggests that the next phase of AI development might be constrained less by demand and more by practical limits: financing capacity, energy availability, and infrastructure buildout challenges.

Peter Smith

Peter Smith

Peter Smith

Peter Smith