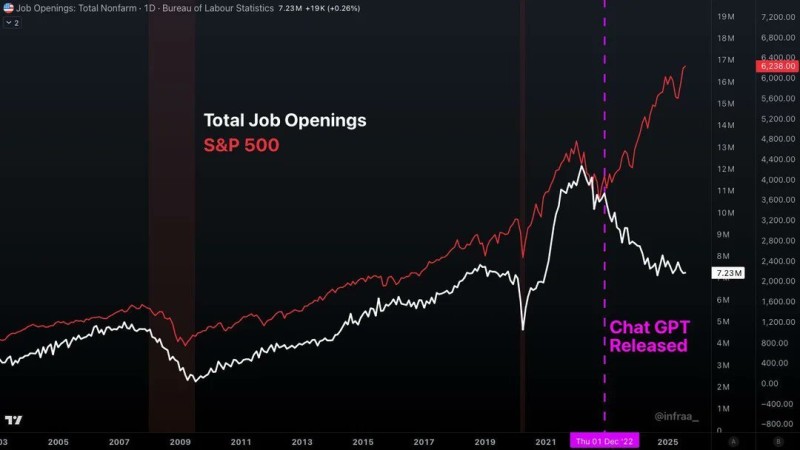

Something unusual is happening in the American economy. Since late 2022, we've witnessed a puzzling disconnect: while the stock market climbs to record heights, available jobs have been steadily shrinking. This isn't a typical recession—it's a fundamental shift in how our economy operates.

A Chart That Captures the Turning Point

A recent observation by The Kobeissi Letter pointed to ChatGPT's release as a symbolic turning point, suggesting we're watching the early stages of an AI-driven transformation that's changing the rules for both workers and investors.

For nearly two decades, job openings and the S&P 500 moved together—rising during expansions, falling during the 2008 crisis and 2020 pandemic. Then December 2022 arrived and everything changed. Job openings plummeted from over 12 million to roughly 7.2 million, while the S&P 500 climbed higher. Companies were growing and profits were flowing, but they weren't posting nearly as many jobs. Something fundamental had shifted.

ChatGPT represents the visible tip of a larger transformation. The AI boom has given companies powerful tools to do more with less, creating efficiency gains across industries. Several forces are driving this shift: AI-driven efficiency reducing the need for traditional labor, corporate caution amid inflation and higher interest rates, and investor optimism that AI adoption will sustain profits even as labor demand weakens.

Breaking the Historical Link

For generations, the connection seemed obvious—more jobs meant more spending, higher revenues, and better stock performance. Now markets are betting that technology-driven productivity can sustain earnings growth without expanding the workforce. This raises urgent questions: Can AI-powered industries generate enough new jobs to replace those automated away? Will productivity alone keep earnings strong if fewer people are working and spending? How sustainable is a market rally built on shrinking employment opportunities?

We're living through one of those rare moments when economic fundamentals get rewritten. For investors, this AI transformation represents both opportunity and risk. For workers, yesterday's valuable skills might not matter tomorrow. And for policymakers, there's an urgent challenge: managing an economy where technological innovation and job creation increasingly pull in opposite directions. These questions will shape not just markets, but society itself, in the years ahead.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah