Talk of a tech bubble is heating up again as AI stocks continue their remarkable run. But according to one veteran market strategist, these concerns might be premature. A recent analysis suggests today's market conditions look nothing like the infamous dot-com peak of 2000.

Challenging the Bubble Narrative

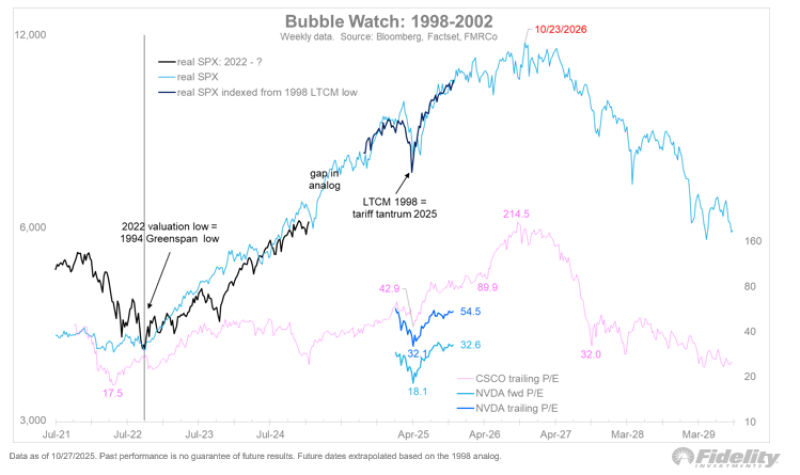

In a recent post on X, Fidelity's Director of Global Macro Jurrien Timmer shared a compelling historical comparison between today's AI market cycle and the dot-com bubble of 1998–2002. "There's a lot of bubble talk out there, but in my view it's still early days," he wrote. "We are nowhere close to the kinds of 'silly season' valuation extremes reached in 2000."

His chart, titled "Bubble Watch: 1998–2002," compares the S&P 500 and Nvidia's price-to-earnings ratios with the Cisco-led internet rally from the late 1990s. The difference is striking. Cisco's P/E ratio peaked around 214x in early 2000, representing the height of internet mania. Meanwhile, Nvidia's P/E ratios today range between 32x trailing and 54x forward—elevated by historical standards, but nowhere near millennium-era extremes.

Nvidia as the New Infrastructure Play

Just as Cisco became the poster child of internet infrastructure in the 1990s, Nvidia now anchors the AI revolution. Its GPUs power everything from ChatGPT to data centers worldwide. But there's a crucial difference this time. Unlike the late 1990s, today's AI sector is built on actual revenue and real-world applications. Nvidia's record-breaking earnings support the idea that current valuations, while rich, aren't pure speculation.

Reading the Market's Timeline

Timmer's analysis suggests the AI market might still be in the mid-cycle optimism phase, not the full-blown mania that defines a true bubble. The chart includes annotations comparing the 2022 valuation low to 1994 and the 1998 LTCM crisis to 2025's tariff concerns. If the pattern holds, we might not see a peak until late 2026.

What This Means for Investors

If Fidelity's framework is correct, we could see another year or more of AI-fueled expansion before approaching the kind of valuation extremes that defined 2000. For investors worried about a repeat of the dot-com crash, there's an important lesson: bubbles only burst after reaching truly irrational levels. As the analysis suggests, the AI rally may still have room to run. We're not in "silly season" yet.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi