The artificial intelligence revolution isn't happening in a vacuum. Behind every breakthrough model and every new capability lies an enormous physical infrastructure of data centers, chips, and computing power. Recently highlighted by zerohedge through an updated Goldman Sachs analysis, the world's largest tech companies are now spending at levels that dwarf any previous technology cycle, betting their futures on AI dominance.

The Spending Explosion

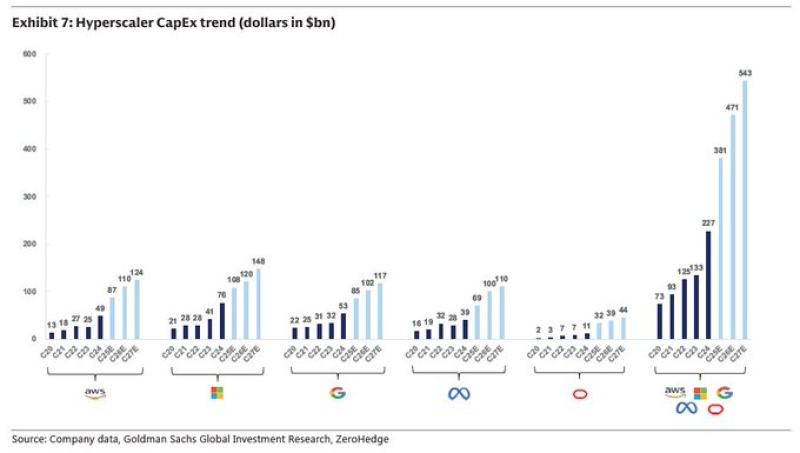

The numbers are staggering. AWS, Microsoft, Google, and Meta are collectively projected to spend over $500 billion annually by 2026 on AI infrastructure. AWS is expected to jump from $13 billion in 2017 to $124 billion by 2025. Microsoft forecasts $148 billion in 2025, driven largely by Azure and its OpenAI partnership. Google is approaching $117 billion as it expands its TPU-powered AI infrastructure, while Meta is nearing $110 billion, much of it supporting AI-driven advertising and metaverse projects.

What's driving this surge? The answer lies in the computational demands of modern AI. Training frontier models like GPT-4 and Gemini requires enormous processing power. Hyperscalers are racing to build data centers specifically optimized for these workloads, creating unprecedented demand for semiconductors from companies like Nvidia and AMD. Meanwhile, enterprise adoption of AI tools continues to accelerate, pushing cloud providers to expand capacity at breakneck speed.

A Vertical Trajectory

The Goldman Sachs chart tells a striking story. Before 2020, capital expenditure growth among these companies followed a relatively steady upward path. Since then, the curve has turned nearly vertical. By 2025, combined spending across the four hyperscalers is projected to reach $543 billion—a figure comparable to the entire GDP of a mid-sized country. This isn't incremental growth. It's a fundamental shift in how these companies allocate resources.

What It Means

For investors and industry watchers, this infrastructure boom presents a complex picture. Companies supplying chips, servers, cooling systems, and other components are positioned to benefit from explosive demand. But the scale of spending also raises important questions about returns. If AI adoption slows, or if regulatory pressures mount, will these massive investments pay off? The bet these companies are making is clear: they believe AI will define the next decade of technology and business growth.

Conclusion

As zerohedge's shared chart makes clear, Big Tech views AI infrastructure as the foundation of future competitiveness. The capital expenditure cycle is accelerating, not slowing. What began as ambitious investments has become an all-out race to build the backbone of the AI economy. The stakes couldn't be higher, and by all indications, this is just the beginning.

Peter Smith

Peter Smith

Peter Smith

Peter Smith