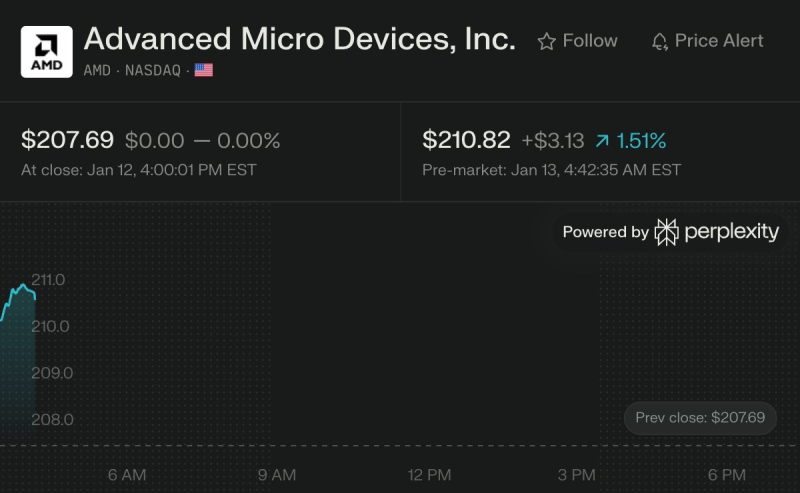

⬤ AMD shares climbed in pre-market trading after KeyBanc Capital Markets flipped its rating to Overweight from Sector Weight and slapped a $270 price target on the stock. The upgrade came after fresh supply chain checks revealed stronger demand for AMD's server CPUs and AI products than anyone expected.

⬤ Here's the backstory: KeyBanc had actually downgraded AMD back in April 2025, worried about a potential gap between the MI355 accelerator and the Helios platform rollout (which uses the MI455 and won't hit volume production until late 2026). But those concerns? Pretty much gone now. Turns out hyperscalers are gobbling up AMD's server chips so fast that the company's nearly sold out for all of 2026. KeyBanc's also hearing AMD might bump prices up 10 to 15 percent in Q1 2026, and they're projecting the server CPU business could grow at least 50 percent this year.

⬤ On the AI GPU front, things are looking solid. KeyBanc's seeing signs that AMD will ship around 200,000 MI355 GPUs in the first half of 2026, then ramp up big time with MI455 units in the second half. For the Helios rack-scale solution, they're targeting somewhere between 290,000 and 300,000 MI455 GPUs. Sure, there's some uncertainty about how many complete racks AMD will actually deliver, but the firm expects AMD to book a major chunk of MI455 and Helios revenue through component sales to its ODM partner, ZT Systems.

⬤ Why does this matter? It shows growing confidence in AMD's data center and AI strategy after months of questions about product timing. The combination of red-hot server CPU demand, potential pricing power, and clearer AI GPU shipment numbers paints a much brighter picture for revenue growth. KeyBanc estimates these factors could drive AI-related revenue to $14 billion to $15 billion this year—proof that when hyperscaler demand shifts, it can completely reshape expectations across the semiconductor and AI hardware world.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova