The data center market is becoming the foundation of the AI-driven economy. Unlike the dot-com era's hype, today's expansion is driven by actual revenue. As businesses across all sectors adopt AI, the need for GPUs and related infrastructure is creating massive sales opportunities for semiconductor companies.

The Numbers Tell the Story

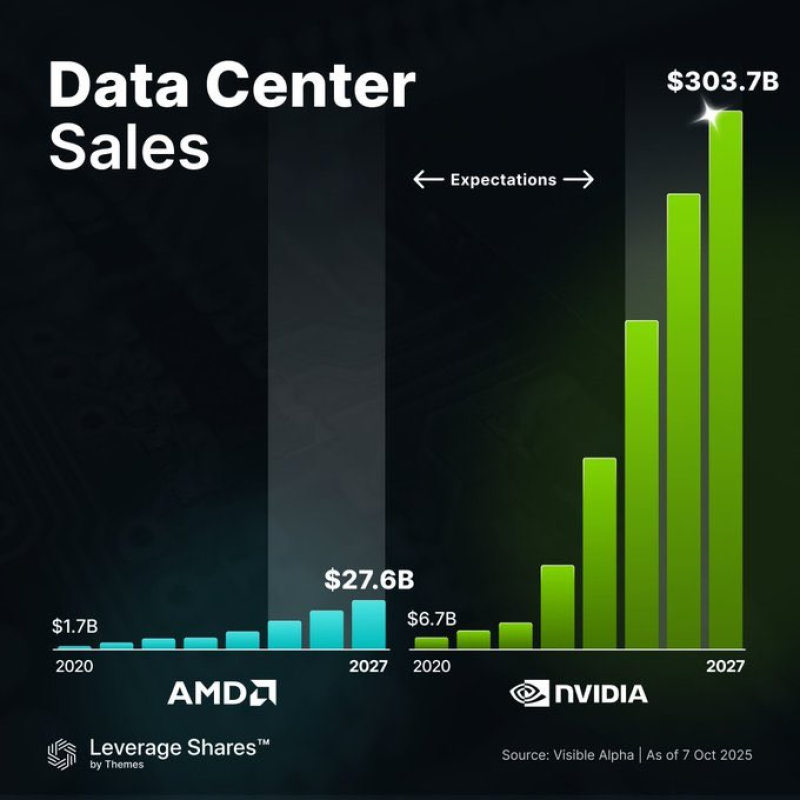

Data center demand has entered what's being called the "AI Infrastructure Supercycle," with Nvidia and AMD positioned as major beneficiaries. Projections show Nvidia's data center revenue climbing from $6.7 billion in 2020 to over $303 billion by 2027—a 45-fold increase. AMD's figures are equally impressive, expected to jump from $1.7 billion to $27.6 billion in the same timeframe, marking a 16-fold rise.

Market analyst Hyper Shark! pointed out that this cycle differs from past tech booms because AI workloads generate real income, not just speculation. Every AI application—whether it's automating business processes or powering advanced language models—needs GPU compute power. This reality explains Nvidia's continued dominance while also highlighting AMD's steady gains in market share.

What's Fueling the Expansion

AI has become ubiquitous. Consumer apps and enterprise cloud services alike demand substantial GPU resources. Major tech companies are investing billions in AI-focused data centers, and the ripple effects extend beyond chip manufacturers to include companies providing racks, power systems, and cooling infrastructure.

Looking Ahead

Nvidia remains the leading force, but AMD's growth trajectory shows there's space for multiple winners in this revolution. The sharp upward trends suggest data center demand hasn't peaked yet. Investors paying attention to the broader infrastructure ecosystem—not just the chip makers themselves—may find compelling opportunities as this supercycle unfolds.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah