The artificial intelligence infrastructure boom continues reshaping market dynamics, with AI cloud stocks delivering some of the most compelling returns in 2025. As enterprise adoption accelerates and compute demands surge, investors are closely tracking which companies are capturing the most value in this explosive growth cycle.

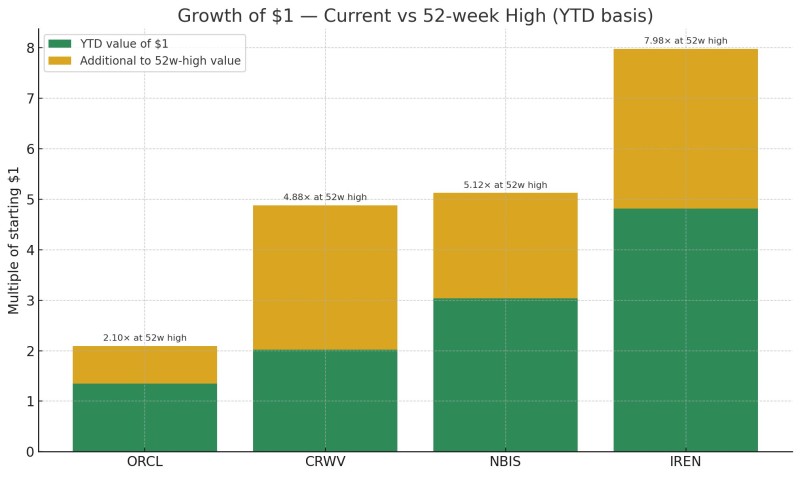

Recent market analysis reveals how major AI cloud infrastructure stocks have performed since the start of the year, with returns varying dramatically across different players in the sector. The data shows each dollar invested at year's beginning has grown between 1.3× and 4.8× depending on the stock.

The performance breakdown compares current year-to-date gains against each stock's 52-week peak, illustrating both realized returns and remaining upside potential across four AI-focused tickers: ORCL, CRWV, NBIS, and IREN.

Oracle Posts 1.3× YTD While Emerging Players Multiply Faster

Oracle (ORCL) shows the most conservative growth at roughly 1.3× year-to-date, with its 52-week high representing a 2.10× total return potential. This makes ORCL the lower-volatility option among AI cloud investments.

The performance gap highlights accelerating demand for AI compute infrastructure, cloud services, and specialized training hardware—sectors where smaller, nimble companies have captured significantly larger market enthusiasm.

CRWV, NBIS, and IREN Show 52-Week High Potential Up to 7.98×

The emerging infrastructure names demonstrate substantially higher growth trajectories:

- CRWV: roughly 2.0× YTD, with 4.88× at 52-week high

- NBIS: approximately 3.1× YTD, reaching 5.12× at peak

- IREN: about 4.8× YTD, climbing to nearly 7.98× at its high—the strongest performer tracked

IREN's explosive peak performance reflects intense capital flows into GPU-heavy compute providers, data center operators, and energy-dependent AI processing infrastructure.

Market Dynamics Driving 2025 AI Infrastructure Growth

The wide performance spread mirrors several key trends shaping AI markets:

- Widespread enterprise adoption of AI systems across industries

- Explosive demand for GPU-driven computing power

- Rapid scaling of cloud-based training workloads

- Strong investor appetite for high-growth AI infrastructure plays

Despite pullbacks from their peaks, all four stocks maintain significant year-to-date gains, demonstrating sustained investor confidence in AI-driven growth potential.

Can AI Cloud Stocks Reach Previous Highs Again?

Market observers expect continued volatility, particularly among smaller AI-focused companies. However, the fundamental demand for compute capacity and AI training infrastructure keeps climbing. If macroeconomic conditions improve or corporate AI spending accelerates further, retesting previous highs could be within reach.

For those tracking AI infrastructure momentum, the data delivers a straightforward takeaway: even after recent corrections, AI cloud stocks remain among the market's top-performing and most dynamic sectors.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi