Robert Kiyosaki isn't your typical financial guru who preaches about saving pennies and living frugally. The man literally wrote the book on thinking differently about money, and his approach has either made him a hero or a controversial figure, depending on who you ask. But love him or hate him, there's no denying that Kiyosaki turned unconventional financial advice into a massive personal fortune.

Early Career: Robert Kiyosaki's First Steps to Wealth

Here's where Kiyosaki's story gets interesting. The guy wasn't always a finance celebrity. After graduating from the U.S. Merchant Marine Academy in 1969, he served as a helicopter gunship pilot in Vietnam. Talk about a different world from financial seminars, right?

When he came back, Kiyosaki landed his first real job at Xerox Corporation in 1974 as a sales rep. He's talked about how that experience taught him everything about selling, which would later become crucial for marketing his ideas. Back then, he was making a pretty standard corporate salary, nothing spectacular. But even while working the nine-to-five, he was already scheming on the side. He started a company that sold those nylon and Velcro surfer wallets. Seemed like a cool idea at the time, but the business eventually tanked. Most people would see that as failure, but Kiyosaki? He turned those lessons into teaching material.

Building the Empire: Robert Kiyosaki Net Worth Growth Through the Decades

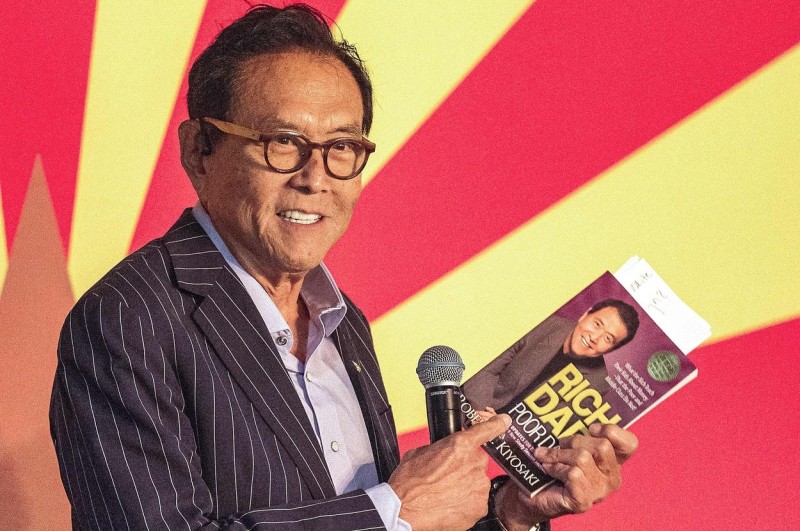

Let's be honest, Kiyosaki's real money didn't come from those early hustles. Everything changed in 1997 when he published "Rich Dad Poor Dad" with Sharon Lechter. The book's concept was simple but powerful: comparing the money mindset of his educated but struggling biological father with his best friend's entrepreneurial dad who built wealth.

The book absolutely exploded. We're talking over 40 million copies sold worldwide, translated into 51 languages. That's insane. Throughout the 2000s, Kiyosaki was everywhere, running seminars, selling his CASHFLOW board game, pumping out sequel after sequel. By 2005, he was pulling in millions every year just from book royalties and speaking gigs alone. The Rich Dad Company became this massive multimedia machine, and robert kiyosaki net worth estimates started hitting the $80 million to $100 million range during those peak years.

Robert Kiyosaki Net Worth Today: Current Financial Status

So where does robert kiyosaki net worth stand today? Most estimates put it somewhere between $100 million and $120 million, though pinning down an exact number is tricky since he keeps a lot of his money in private investments. Kiyosaki's always been loud about his strategy: real estate, gold, silver, and more recently, he's gone all-in on Bitcoin and crypto.

But it hasn't all been smooth sailing. In 2012, one of his companies, Rich Global LLC, went bankrupt after losing a lawsuit and getting hit with a nearly $24 million judgment. Kiyosaki brushed it off, saying it was just smart business strategy, not a personal financial crisis. He actually used it as another teaching moment, arguing that knowing how to use bankruptcy law is part of being financially savvy. Classic Kiyosaki move, turning a potential PR disaster into a lesson.

These days, you'll find him constantly on Twitter dropping predictions about economic crashes and telling people to buy gold and Bitcoin instead of keeping cash in the bank. The man's 76 and still hustling his message every single day.

Core Principles: Kiyosaki's Philosophy on Becoming Successful

What's Kiyosaki's secret sauce that made millions of people buy into his philosophy? First off, he flips conventional wisdom on its head with the whole assets versus liabilities thing. He'll straight up tell you that your house isn't an asset if it's draining money from your pocket every month. Instead, he wants you focused on buying things that actually put money back: rental properties, businesses, dividend-paying stocks.

Second, the guy's a broken record about financial education. He thinks the school system completely fails us by not teaching anything practical about money. That's where his CASHFLOW Quadrant comes in, splitting people into four groups: Employees, Self-Employed folks, Business Owners, and Investors. His whole philosophy is about moving from the left side where you're trading time for money to the right side where your money works for you while you sleep.

Third, and this is where he really ruffles feathers, Kiyosaki actually encourages taking on debt. Not stupid debt for cars and vacations, but strategic debt to buy assets. He thinks playing it safe and just saving money is actually the riskiest move you can make because inflation eats away at your cash while you're sitting there feeling responsible. He wants people starting businesses, buying real estate, learning to leverage other people's money. It's controversial as hell, but that's exactly why people either worship the guy or think he's dangerous. There's really no middle ground with Kiyosaki.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov