Ray Dalio is a legendary figure in the world of finance and investing. He is the founder and co-chief investment officer of Bridgewater Associates, a Connecticut-based hedge fund that manages over $150 billion in assets.

Intro

Ray Dalio is a legendary figure in the world of finance and investing. He is the founder and co-chief investment officer of Bridgewater Associates, a Connecticut-based hedge fund that manages over $150 billion in assets.

Dalio's investment philosophy is based on a set of principles that he has developed over the course of his career, including the importance of radical transparency, the power of data analysis, and the need to embrace failure as a learning experience.

Dalio's approach to investing has been highly successful, and he is widely regarded as one of the most successful investors of all time. He has been featured in numerous publications, including Forbes, The New York Times, and The Wall Street Journal, and he has written several books on investing and economics.

In addition to his work in finance, Dalio is also a philanthropist. He has pledged to give away most of his wealth to charity, and he has donated millions of dollars to a variety of causes. He is also a champion of education and has been involved in a number of initiatives aimed at improving education in the United States.

Early Years and Education

Ray Dalio was born on August 8, 1949, in Jackson Heights, Queens, New York City. He grew up in a middle-class family, the son of a jazz musician and a homemaker. His parents were both children of Italian immigrants.

As a child, Ray Dalio was interested in the stock market and investing. He began investing in stocks when he was just 12 years old, using money he earned from caddying at a local golf course. He would read the financial pages of the newspaper every day and study the stock market.

Despite his interest in investing, Ray Dalio initially pursued a different career path. He attended Long Island University, where he earned a degree in finance. After graduation, he worked at a number of different jobs, including as a clerk on the floor of the New York Stock Exchange.

First Job

Dalio attended Long Island University, where he earned a bachelor's degree in finance. He then went on to receive an MBA from Harvard Business School in 1973.

After completing his MBA, Dalio worked at a number of financial firms, including Dominick & Dominick and Shearson Hayden Stone. In 1975, he founded Bridgewater Associates, a hedge fund that would go on to become one of the most successful in history.

Ray Dalio's wife and family

As for his family life, Ray Dalio has been married twice. He married his first wife, Eve, in 1973, and they had four children together. However, Eve tragically died in a car accident in 1991.

In 2004, Ray Dalio married his second wife, Barbara, who is also his business partner. They met when Barbara was working as a marketing executive for Bridgewater Associates. They have three children together.

Ray Dalio Principles in Trading

Dalio's investment philosophy is based on a number of principles that he has developed over the course of his career. These include:

- Radical transparency: Dalio believes that the best decisions are made when everyone involved has access to all the relevant information.

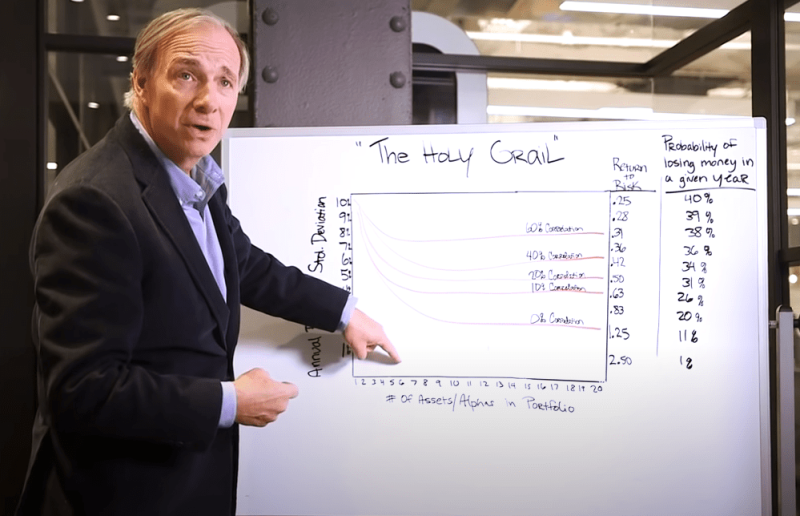

- The importance of diversification: Dalio believes in spreading risk across a range of different investments.

- The power of data: Dalio uses data analysis to inform his investment decisions, and he believes that data can help investors identify patterns and trends in the market.

- The need to embrace failure: Dalio sees failure as an opportunity to learn and grow, and he encourages his team to be open about their mistakes and use them as a learning experience.

Ray Dalio Portfolio

Dalio's portfolio is managed by Bridgewater Associates, the hedge fund he founded in 1975. Bridgewater's investment strategy is based on a number of different funds, each with a specific investment objective. The firm's flagship fund, Pure Alpha, is designed to generate high returns by making bets on macroeconomic trends.

In addition to Pure Alpha, Bridgewater also manages several other funds, including All Weather, which is designed to perform well in all market conditions, and Optimal Portfolio, which is designed to provide high returns with low risk.

Dalio's portfolio also includes a number of individual stocks, which are carefully selected based on the firm's analysis of market trends and economic indicators. Some of the stocks in Dalio's portfolio include Alibaba, Amazon, Facebook, and Microsoft.

Overall, Dalio's portfolio is known for its diversity and its focus on long-term investment strategies. The portfolio is managed by a team of experienced analysts and investment professionals, who use data analysis and other tools to identify trends and make informed investment decisions.

While Dalio's portfolio is closely watched by investors around the world, it is important to keep in mind that investing carries risk and that past performance is not a guarantee of future success.

Conclusion

Ray Dalio is one of the most successful investors of our time, and his investment principles have been studied and emulated by countless investors around the world.

His commitment to radical transparency, diversification, and data analysis has helped him achieve extraordinary success, and his willingness to embrace failure has made him a role model for investors and entrepreneurs alike.

Peter Smith

Peter Smith

Peter Smith

Peter Smith