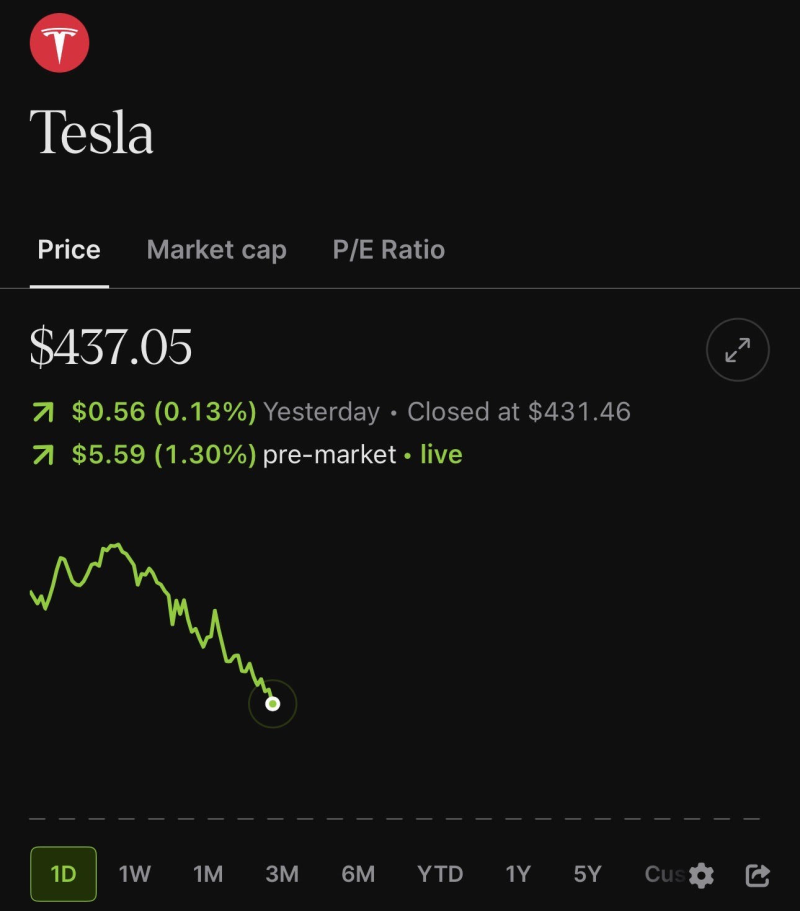

⬤ TSLA traded higher in early pre-market sessions, moving from $431.46 to around $437. The uptick came after Musk's comments positioned Tesla less as an electric vehicle manufacturer and more as a company deploying AI systems in the real world. Shares reflected initial optimism about this strategic redirection.

⬤ Tesla's long-term vision now centers on autonomous fleet services, humanoid robotics, and proprietary AI platforms. The roadmap includes the Cybercab autonomous vehicle, the Optimus humanoid robot, and internally developed AI chips called AI5 and AI6. "We're moving toward a world where intelligence gets deployed repeatedly across physical systems," Musk explained during the call. Instead of depending mainly on consumer EV sales, Tesla wants to scale value through AI-driven products and services.

⬤ The company is ramping up compute capacity and real-world data collection to accelerate autonomy development. Tesla referenced expanding compute infrastructure through Cortex 2 and accumulating roughly 650,000 robotaxi miles. More compute power combined with larger datasets should improve autonomous performance, following principles seen across AI development broadly.

⬤ This matters because it changes how investors might evaluate TSLA going forward. Focusing on AI, robotics, and autonomous services introduces different growth opportunities and risks compared to traditional car manufacturing. The pre-market movement shows the market beginning to weigh how this transition could position Tesla within the expanding AI economy and the commercialization of autonomous tech.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah