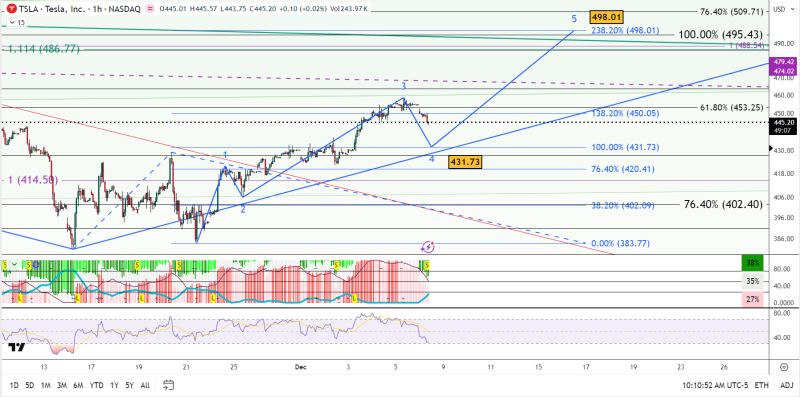

⬤ Tesla shares have dropped after a recent peak. Chart watchers now see $431.73 as the next key price. The stock has eased from the mid-$440s and heads toward a group of support marks. The fall looks like a routine pullback after the strong climb that began in late November. The chart model views the move as a normal rest, not a collapse and sets $431 as the probable spot for a rebound before the next rise.

⬤ The $431.73 mark matches a 100 % Fibonacci extension plus rests where earlier sideways ranges and trend-line support meet. Momentum tools show tiredness after the long climb - oscillators have tightened and short-term mood has turned neutral. The wider view stays positive. The model plots a route through the $450 region then targets a fifth wave push to $498.01. “The model marks 431.73 as the next big support - the stock will probably slip into that zone before it tries to climb again,” the analyst said.

⬤ Recent trade fits this hand over phase. Tesla surged from the low $414s, cleared several week resistance then reached this turning point. The retreat looks calm - it follows the pattern of earlier dips rather than hinting at deeper trouble. Higher Fibonacci levels from $495 to $498 are flagged as possible magnets if the uptrend holds giving traders plain levels to watch.

⬤ The interest now is that Tesla stands at a junction. Its action near $431 could steer mood across fast growing tech names. If the price stays above that figure but also moves toward $498, the current bull run gains credit. If the price falls through $431, traders must revise the near term view.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova