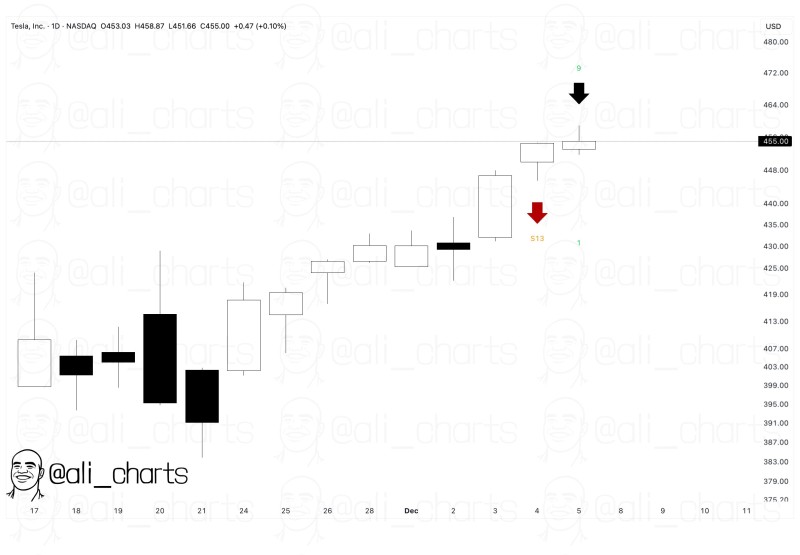

⬤ Tesla stock is kicking off an important week with TD Sequential sell signals lighting up across the daily chart. The setup suggests momentum might be cooling off after shares closed around $455 while printing a TD 9 candle—a pattern traders typically watch for signs of short-term exhaustion.

⬤ Two key signals stand out on the chart: a TD 9 near the recent peak between $465 and $472, and an S13 signal just below that zone. Both mark spots where previous rallies hit the brakes, hinting that the current push might be running out of steam. The quick run from the low-430s to mid-450s happened fast, and the tight price action now showing could mean buyers are starting to hesitate.

⬤ That said, Tesla's chart still looks relatively healthy with higher lows building since late November. But these TD sell signals raise the possibility of near-term consolidation if price can't push decisively past the resistance zone. The stock's sitting at a decision point where it could either catch a second wind or cool down for a bit.

⬤ This matters because Tesla carries serious weight as a market mover. How the stock responds to these technical signals could shift sentiment across the entire tech sector, especially as traders debate whether this rally has more room to run. A clean break above resistance would prove the sell signals wrong, while rejection at current levels would confirm the warning and potentially reset expectations for the weeks ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis