It's the kind of play that prop traders live for: catching a bounce off support while managing tight risk limits. With $25K on the line and strict drawdown rules, every tick matters.

The Trade Setup

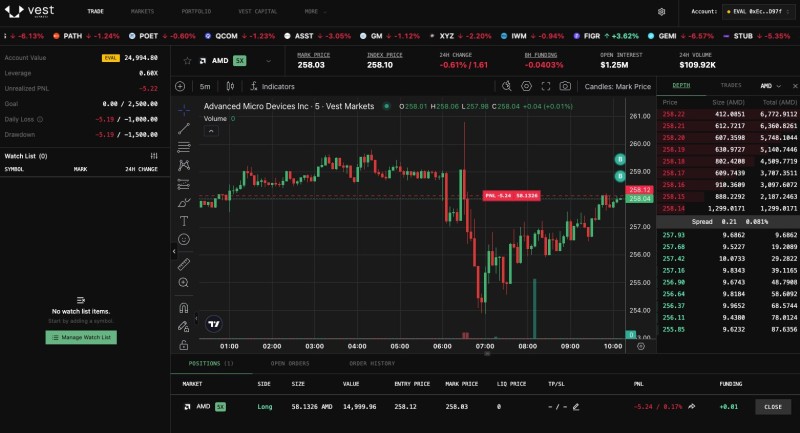

During a choppy Friday session, trader John The Rock Trading Co. gave followers a peek inside their VestMarkets funded evaluation—taking a leveraged long position on AMD right after the chip stock got hammered in early trading.

According to the VestMarkets dashboard, here's how the position looked:

- Entry price: $258.12 per share

- Position size: $15,000 (0.6x leverage)

- Unrealized P&L: –$5.24 at capture

- Profit target: $2,500

- Max daily loss: $1,000

- Max drawdown: $1,500

The 5-minute chart tells the story: AMD opened around $260, got smacked down to $255.80, then bounced hard off support into a V-shaped recovery. By the time jumped in, the stock was consolidating near $258—just below entry—with decent volume suggesting buyers were stepping back in. Holding above $257 keeps the bullish case alive, while a break above $260 could open the door to $262–$264.

Why AMD, Why Now?

AMD's intraday weakness mirrors broader semiconductor volatility this week. Mixed earnings, AI chip export worries, and general sector jitters have been shaking names like NVIDIA and Intel too. But that's exactly what makes AMD attractive for short-term traders—high liquidity, tight spreads, and reactive price action. For prop evaluations like this one, it's a perfect testing ground.

This trade is a textbook example of risk-managed speculation: small leverage, clear levels, and a disciplined approach to a funded evaluation. Whether

Peter Smith

Peter Smith

Peter Smith

Peter Smith