+40% Estimated Revenue YoY

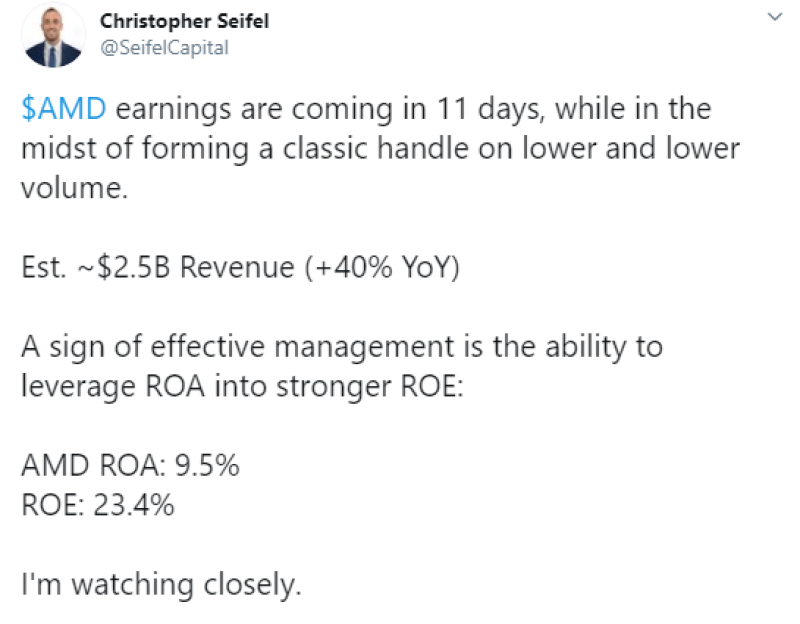

Christopher Seifel, an equity research analyst, believes AMD's quarterly report, which will be out on October 27, should be a source of scrutiny for the company. He notes a significant increase in the company's profit, it is estimated that it will reach 40% compared to last year.

Target Price Is Raised before the Report

Besides, according to The Street, an analyst at RBC Capital Markets has increased the target price of AMD shares from $84 to $92. The analyst is confident that the company's fundamentals remain strong and expects positive reporting as demand for the gaming and data center segments increases, which benefits AMD directly.

Earlier in October, the Bank of America conducted a survey of investors on the prospects for AMD shares. More than 78% are confident that the trend will be bullish long term, and among the main factors contributing to the growth, they noted the following the company's own roadmap, regarding new processors with Zen 3 and Zen 4 architecture, as well as the weak performance of AMD's main competitor, Intel.

This growth also has a fundamental rationale. Very soon, AMD will hold several presentations of its new products, which is promised to be loud. In early October, on the 8th, the company will present new CPUs, which use innovative Zen 3 architecture designed by AMD. On October 28, the company announced the presentation of the new GPU's on the new RDNA 2 architecture line.

Most likely, the new graphics processors will allow the company to directly compete with Nvidia, which by the end of this month will already release their next-generation GPUs on sale, which promise to double the performance of more than the previous generation models for the same price. Apparently, AMD is going to give a serious battle to Nvidia on its own territory.

Usman Salis

Usman Salis

Usman Salis

Usman Salis